Image Source:

Image Source:

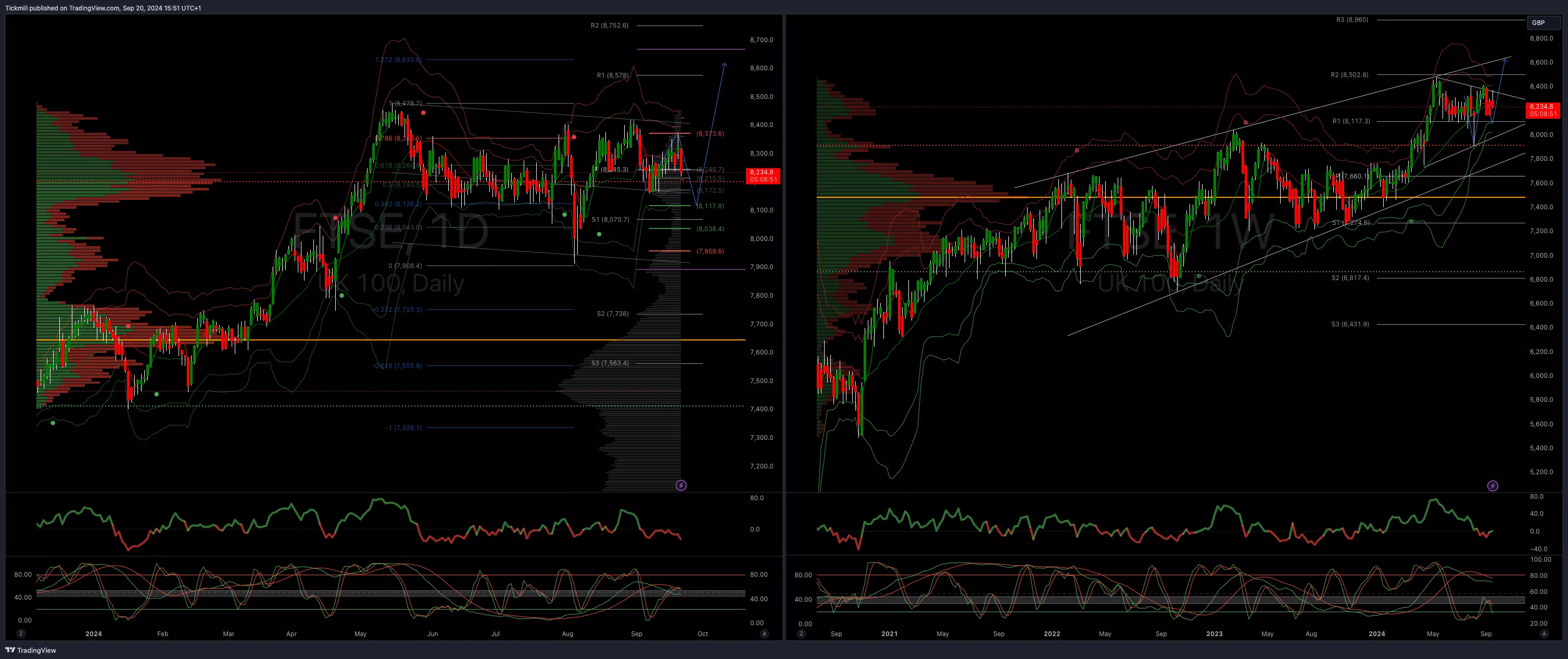

Friday saw a dip in UK equities while the British pound strengthened. However, the stock index was expected to post weekly gains due to an increase in global risk appetite following the significant rate cut by the U.S. Federal Reserve. Due to the pressure from the strengthening British pound on export-orientated businesses, the FTSE 100 dropped 1%. The more locally orientated midcap index dropped as well.August saw a stronger-than-expected 1% increase in British retail sales, above estimates for a 0.4% monthly increase and an upward revision to growth in July.The Federal Reserve dropped rates by 50 basis points this week, and the Bank of England decided to hold rates at its meeting on Thursday. As a result, the pound has strengthened versus the dollar to its highest level since 2022. The data helped support this advance. Following the Fed’s 50 basis point cut, markets rose on Thursday, with the FTSE 100 reaching a two-week high. Though the Fed and European Central Bank are both anticipated to lower interest rates more quickly than the BoE, UK stocks are still trailing both US and euro zone equities this year.Friday’s losses were widespread, with all sector indices falling or remaining unchanged, and the personal goods index falling by 4.5%. In single stock stories, Burberry, a British luxury fashion brand, has fallen to the bottom of the blue-chip index after Jefferies downgraded its rating to “underperform” from “hold” and lowered its target price to 490 pence from 800 pence. The stock is the biggest percentage loser on the FTSE benchmark index, with a 4.3% drop to 599.6 pence. Jefferies cites a change in management and a challenged demand backdrop, making for an especially uncertain future for Burberry. Analysts also believe that a prolonged downturn in luxury spending in China is unlikely to reverse this year. Last week, Barclays also cut Burberry’s rating to “underweight” from “equal weight”. Fifteen out of 20 analysts covering the stock have a “hold” rating.Dr Martens shares fell 10.3% to a record low as Goldman Sachs sells 70 million shares at 57.85p, a 9.8% discount to the previous close. The stock is the top loser in the London all share index, with DOCS down 28% YTD compared to FTAS’s 8% rise.Investec, a British asset management firm, saw its shares fall by around 3% to 574 pence.The business plans to announce half-year headline profits per share of 35.3 pence to 38.2 pence, a 1.4% decrease to a 3.5% increase over the previous period. The group’s adjusted operational pre-tax profit for the first half is forecast to range between 450 million and 482 million pounds, compared to 441.4 million pounds last year. According to Investec, the group’s trading remains consistent with its fiscal year 2025 guidance. The stock has risen almost 8% year to date.

Technical & Trade ViewFTSE Bias: Bullish Above Bearish below 8225

(Click on image to enlarge) FTSE Off Best Levels As BoE Stands Pat, Sterling ShinesSP500 Daily Trade Plan – Thursday, September 19FTSE Investors Cautious As Fed Decision On Deck Ahead Of BoE

FTSE Off Best Levels As BoE Stands Pat, Sterling ShinesSP500 Daily Trade Plan – Thursday, September 19FTSE Investors Cautious As Fed Decision On Deck Ahead Of BoE