The US jobs report was incredibly strong on every front possible – job creation, unemployment, wages and hours worked. Nonetheless, caution lingers given the lack of corroborating data. While the inflation backdrop is allowing the Fed to start moving monetary policy back to neutral, we think it will be in 25bp incremements, not the 50bp we saw in September.

Number of US jobs added in September

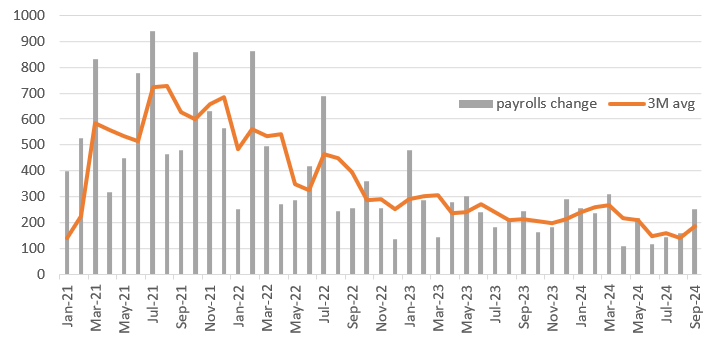

Job surge beats all expectationsThe September jobs report is unambiguously strong. US non-farm payrolls rose 254k versus the 150k consensus and there were 72k of upward revisions to the past two months of data (the range of expectations was 70k up to 220k). The unemployment rate fell to 4.1% from 4.2%, which only one person out of 71 predicted while wages rose 0.4% month-on-month with August’s rate revised up 0.1pp to 0.5% MoM. On the face of this the Fed should be hiking rates with these sorts of figures, not cutting rates. Monthly change in non-farm payrolls (000s)(Click on image to enlarge) Source: Macrobond, ING Data inconsistencies linger, but we don’t see the Fed cutting rates by more than 25bp in NovemberThe problem is that none of this tallies with any of the other data. ISM, NFIB and the Fed’s own Beige Book are not suggesting that hiring is anywhere close to this while the sharp falls in the quits rate normally heralds a slowdown in wage growth, not an acceleration. Moreover, households themselves are telling survey compilers that the jobs market is weakening rapidly so I suspect there will be a degree of scepticism about this report. Either way though the Fed is not cutting rates 50bp in November. 25bp remains our call and the market has swung from pricing 33bp of cuts in November ahead of the release to 27bp in the immediate aftermath. Unemployment rate versus Conference Board measure of jobs plentiful less jobs hard to get(Click on image to enlarge)

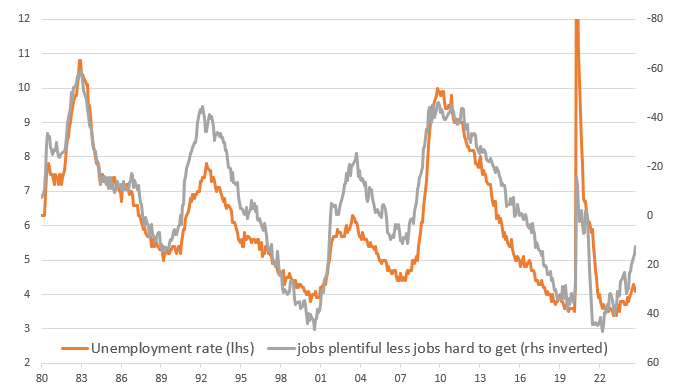

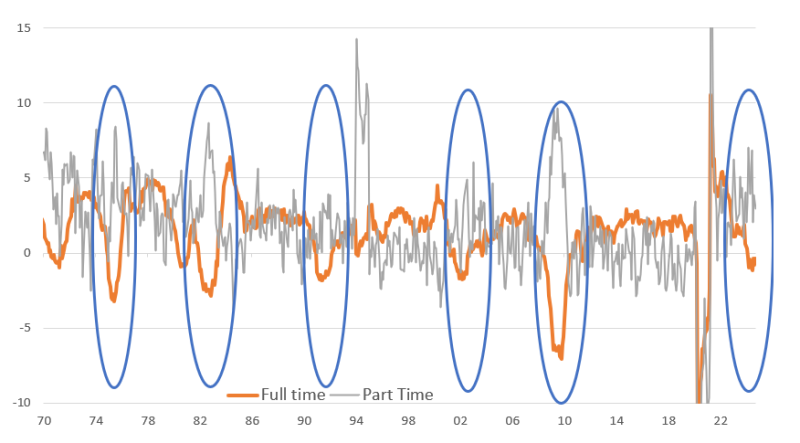

Source: Macrobond, ING Data inconsistencies linger, but we don’t see the Fed cutting rates by more than 25bp in NovemberThe problem is that none of this tallies with any of the other data. ISM, NFIB and the Fed’s own Beige Book are not suggesting that hiring is anywhere close to this while the sharp falls in the quits rate normally heralds a slowdown in wage growth, not an acceleration. Moreover, households themselves are telling survey compilers that the jobs market is weakening rapidly so I suspect there will be a degree of scepticism about this report. Either way though the Fed is not cutting rates 50bp in November. 25bp remains our call and the market has swung from pricing 33bp of cuts in November ahead of the release to 27bp in the immediate aftermath. Unemployment rate versus Conference Board measure of jobs plentiful less jobs hard to get(Click on image to enlarge) Source: Macrobond, ING Full-time versus part-time employment doesn’t look greatWithin the details it is yet again down to the three sectors of leisure & hospitality (+78k), private education and healthcare (+81k) and government (+31k). So the majority of jobs are tending to be more orientated to part time, lower paid and less secure work. Note that full-time employment in the US has been negative year-on-year for eight consecutive months. Consequently, there continues to be question marks over the quality of the jobs that are being added. I’ll just throw in this chart showing periods when full-time employment has fallen and part-time employment has risen – the blue circles. I’ll leave you to look up what happened in the immediate aftermath of those periods… YoY% change in employment – full-time versus part-time(Click on image to enlarge)

Source: Macrobond, ING Full-time versus part-time employment doesn’t look greatWithin the details it is yet again down to the three sectors of leisure & hospitality (+78k), private education and healthcare (+81k) and government (+31k). So the majority of jobs are tending to be more orientated to part time, lower paid and less secure work. Note that full-time employment in the US has been negative year-on-year for eight consecutive months. Consequently, there continues to be question marks over the quality of the jobs that are being added. I’ll just throw in this chart showing periods when full-time employment has fallen and part-time employment has risen – the blue circles. I’ll leave you to look up what happened in the immediate aftermath of those periods… YoY% change in employment – full-time versus part-time(Click on image to enlarge) Source: Macrobond, ING Be wary of the consumer’s reactionOur base case remains that the US can achieve a soft landing on the assumption that a fundamentally sound economy responds to rate cuts and greater political clarity after the election. Nonetheless, we feel that the risks remain skewed towards weaker growth and lower Fed funds given the perception amongst households of a deteriorating jobs market (even if today’s numbers don’t confirm that), which may lead to consumers spending more cautiously. This is hugely important given consumer spending is around 70% of GDP. We will have to wait and see. For now we continue to expect 25bp rate cuts through to next summer with the Fed funds bottoming at around 3.25-3.5%, whereas the market has it dropping to just below 3%.What Israel’s Potential Response Could Mean For The Oil Market Rates Spark: If 150K Is Delivered, We Head For 4% Asia Week Ahead: South Korea’s Central Bank Meeting Takes Centre Stage

Source: Macrobond, ING Be wary of the consumer’s reactionOur base case remains that the US can achieve a soft landing on the assumption that a fundamentally sound economy responds to rate cuts and greater political clarity after the election. Nonetheless, we feel that the risks remain skewed towards weaker growth and lower Fed funds given the perception amongst households of a deteriorating jobs market (even if today’s numbers don’t confirm that), which may lead to consumers spending more cautiously. This is hugely important given consumer spending is around 70% of GDP. We will have to wait and see. For now we continue to expect 25bp rate cuts through to next summer with the Fed funds bottoming at around 3.25-3.5%, whereas the market has it dropping to just below 3%.What Israel’s Potential Response Could Mean For The Oil Market Rates Spark: If 150K Is Delivered, We Head For 4% Asia Week Ahead: South Korea’s Central Bank Meeting Takes Centre Stage