On Wednesday, I joined the great Stuart Varney on Fox Business to discuss Stock Market, Inflation, Fed, Liquidity, Outlook and more. Thanks to Stuart, Christian Dagger and Preston Mizell :Here were my “show notes” ahead of the segment:

On Wednesday, I joined the great Stuart Varney on Fox Business to discuss Stock Market, Inflation, Fed, Liquidity, Outlook and more. Thanks to Stuart, Christian Dagger and Preston Mizell :Here were my “show notes” ahead of the segment: On Tuesday, I joined the great Henry Yin on CNA Live Singapore to discuss Stock Market, Earnings and more. Thanks to Marianne Starr Inacay General MarketIn our recent week |(s) we have said to expect 3 key developments:

On Tuesday, I joined the great Henry Yin on CNA Live Singapore to discuss Stock Market, Earnings and more. Thanks to Marianne Starr Inacay General MarketIn our recent week |(s) we have said to expect 3 key developments:

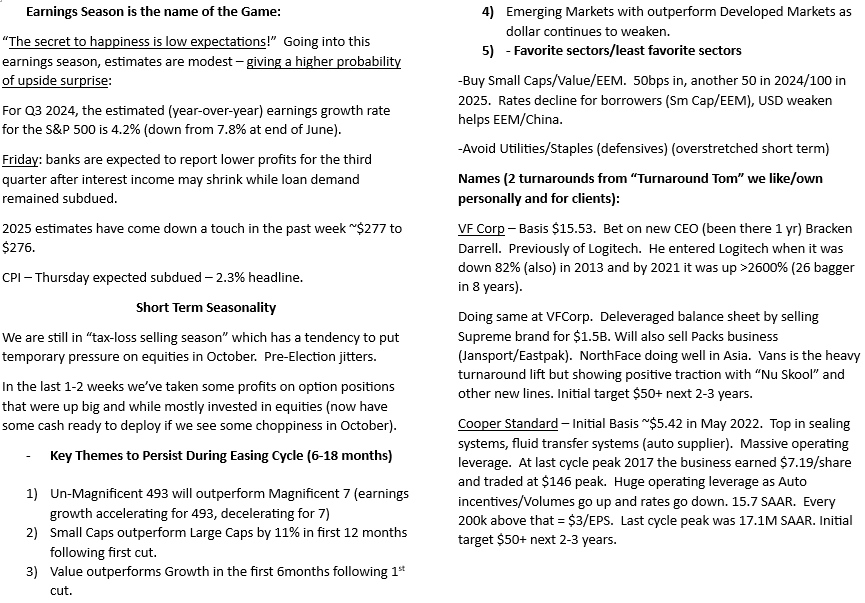

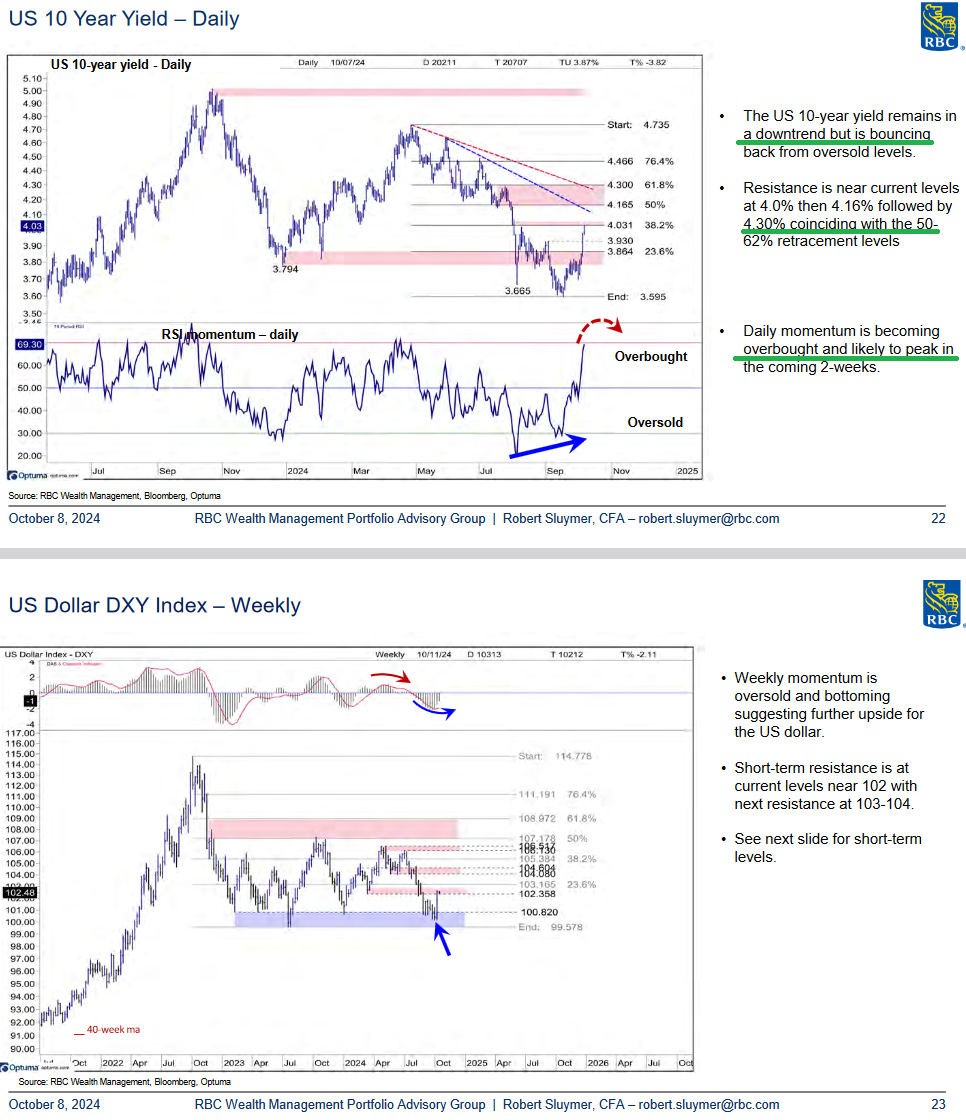

- A counter-trend rally in the U.S. Dollar despite the intermediate term trend being down.

- A counter-trend rally in the US Treasury 10yr yield despite the intermediate term trend being down.

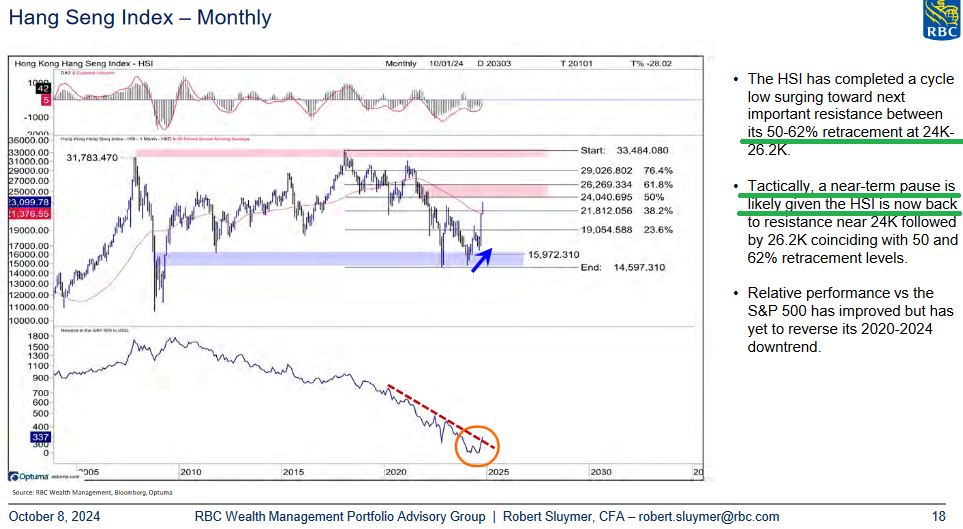

- A punishing consolidation for everyone who bought Chinese stocks/Alibaba after it rallied 50% off the lows in a matter of weeks. This is healthy and will take out the late money (weak sisters) before the next move higher. I anticipate this pullback will last a couple of weeks to a couple of months. Once all of the new money that chased up gets flushed in the hole we will power back above $120 and beyond again.

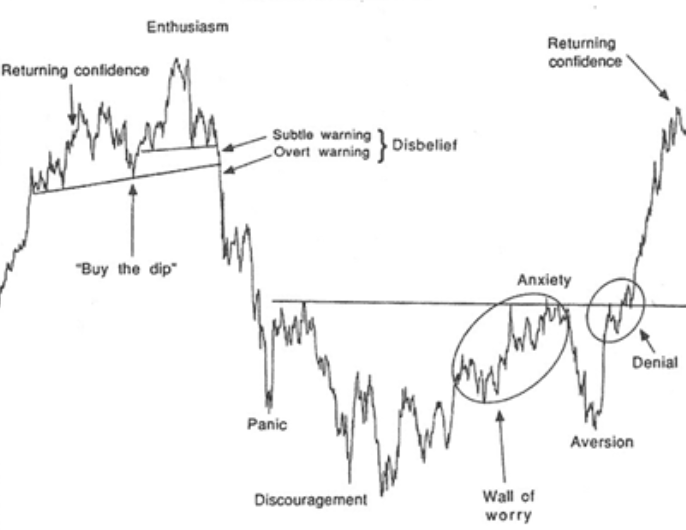

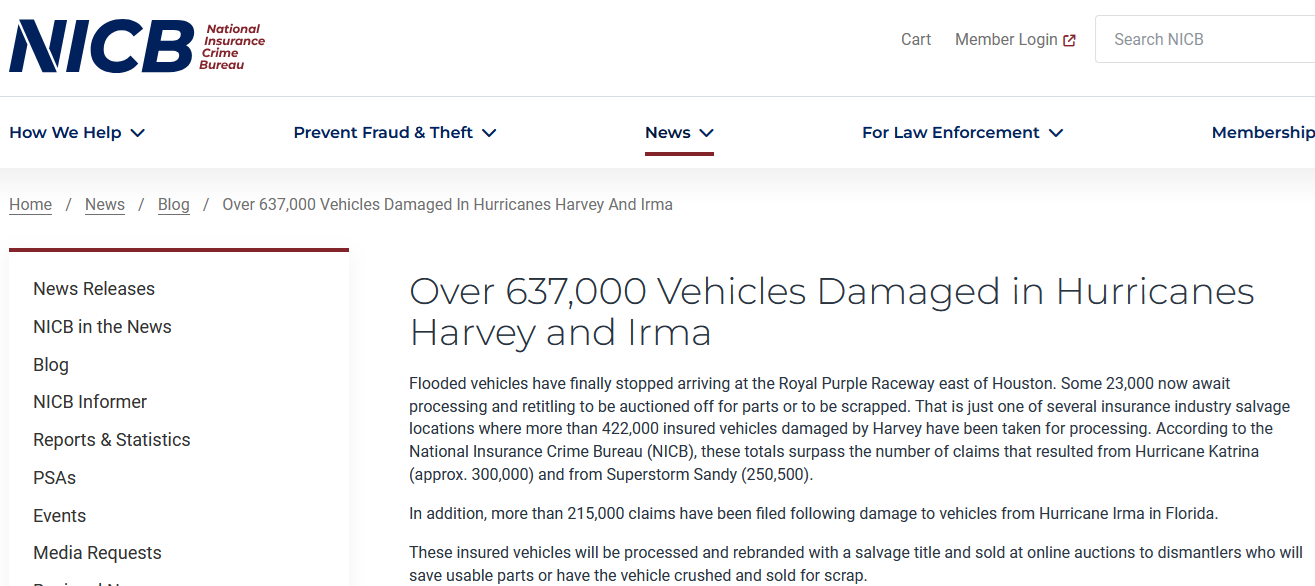

If you look at the featured image of Alibaba at the top of this article, you will find the current pattern is pretty normal after coming out of “despondency.” The question is whether the current blue circle is like circle 1 (several months of violent consolidation before huge move higher), or circle 2 (several days or weeks of moderate consolidation before huge move higher). We favor the latter but are open minded as the intrinsic value is still dramatically higher than the current price. We would love a chance to reload long dated options (would have to temporarily drop below $100/share for me to execute on that) for another ~5x+ bagger (depending on vintage) but we are content just owning all of the stock for the long term. We have not sold 1 share (and we own a ton).See recent BABA update here – also link to Babalicious update priorSo where is BABA on the Justin Mamis emotional cycle? You tell me…and don’t deny it! Cooper StandardIn one of my recent |(s) I mentioned that I estimated ~$3/share in EPS for every 200,000 cars above 15.7M annual SAAR.See recent CPS update here – also link to”Volumes are the Name of the Game” update priorHurricane Milton is a tragedy. It will leave devastation in its path destroying homes, schools, hospitals and more. It will also destroy a lot of cars that will be total losses and replaced with new ones by insurance companies (and owners).One of the points we have emphasized repeatedly is that in 2017 when Cooper Standard earned $7.19/share and traded at $146/share the US had ~17.1M SAAR. What I did not realize is that was the same year that and hit the US hard and took 637,000 cars with it – that needed to be replaced and helped with the peak SAAR number.

Cooper StandardIn one of my recent |(s) I mentioned that I estimated ~$3/share in EPS for every 200,000 cars above 15.7M annual SAAR.See recent CPS update here – also link to”Volumes are the Name of the Game” update priorHurricane Milton is a tragedy. It will leave devastation in its path destroying homes, schools, hospitals and more. It will also destroy a lot of cars that will be total losses and replaced with new ones by insurance companies (and owners).One of the points we have emphasized repeatedly is that in 2017 when Cooper Standard earned $7.19/share and traded at $146/share the US had ~17.1M SAAR. What I did not realize is that was the same year that and hit the US hard and took 637,000 cars with it – that needed to be replaced and helped with the peak SAAR number. If Milton is anything like these two devastating Hurricanes in 2017 – there will be another half million new cars required more than estimated over the next 6 months. Using the rough operating leverage formula I have calculated – and the impact on EPS for CPS, it is possible we could hit our earnings target sooner than anticipated and the implications would be massive. Time will tell. If Milton is not as extreme as anticipated, the previous timeline is still in play. If Milton wreaks unexpected havoc, our timeline could be quickly accelerated.

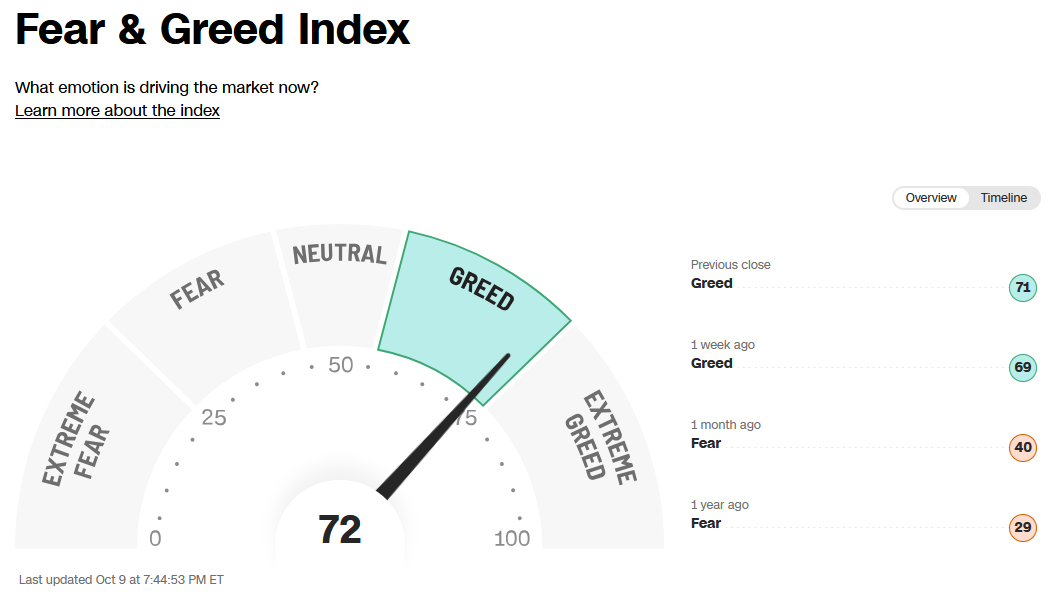

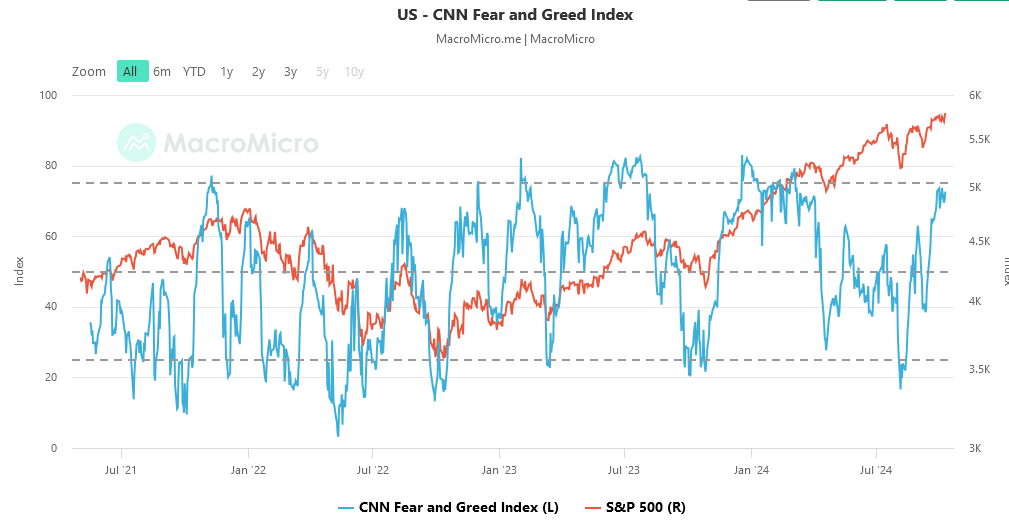

If Milton is anything like these two devastating Hurricanes in 2017 – there will be another half million new cars required more than estimated over the next 6 months. Using the rough operating leverage formula I have calculated – and the impact on EPS for CPS, it is possible we could hit our earnings target sooner than anticipated and the implications would be massive. Time will tell. If Milton is not as extreme as anticipated, the previous timeline is still in play. If Milton wreaks unexpected havoc, our timeline could be quickly accelerated. Now onto the shorter term view for the General Market:The CNN “Fear and Greed” moved up from 69 last week to 72 this week. You can learn how this indicator is calculated and how it works here: ()

Now onto the shorter term view for the General Market:The CNN “Fear and Greed” moved up from 69 last week to 72 this week. You can learn how this indicator is calculated and how it works here: ()

The NAAIM (National Association of Active Investment Managers Index) () ticked up to 86.93% this week from 86.64% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) () ticked up to 86.93% this week from 86.64% equity exposure last week. Congratulations to all of the new clients that came in during our early Q2 and Q3 raises. We re-opened to smaller accounts $1M+ again starting last Wednesday and will remain open until the end of next week. To see if you qualify and to take advantage of this opening click . Larger accounts $5-10M+ can access bespoke service at their preference .

Congratulations to all of the new clients that came in during our early Q2 and Q3 raises. We re-opened to smaller accounts $1M+ again starting last Wednesday and will remain open until the end of next week. To see if you qualify and to take advantage of this opening click . Larger accounts $5-10M+ can access bespoke service at their preference .