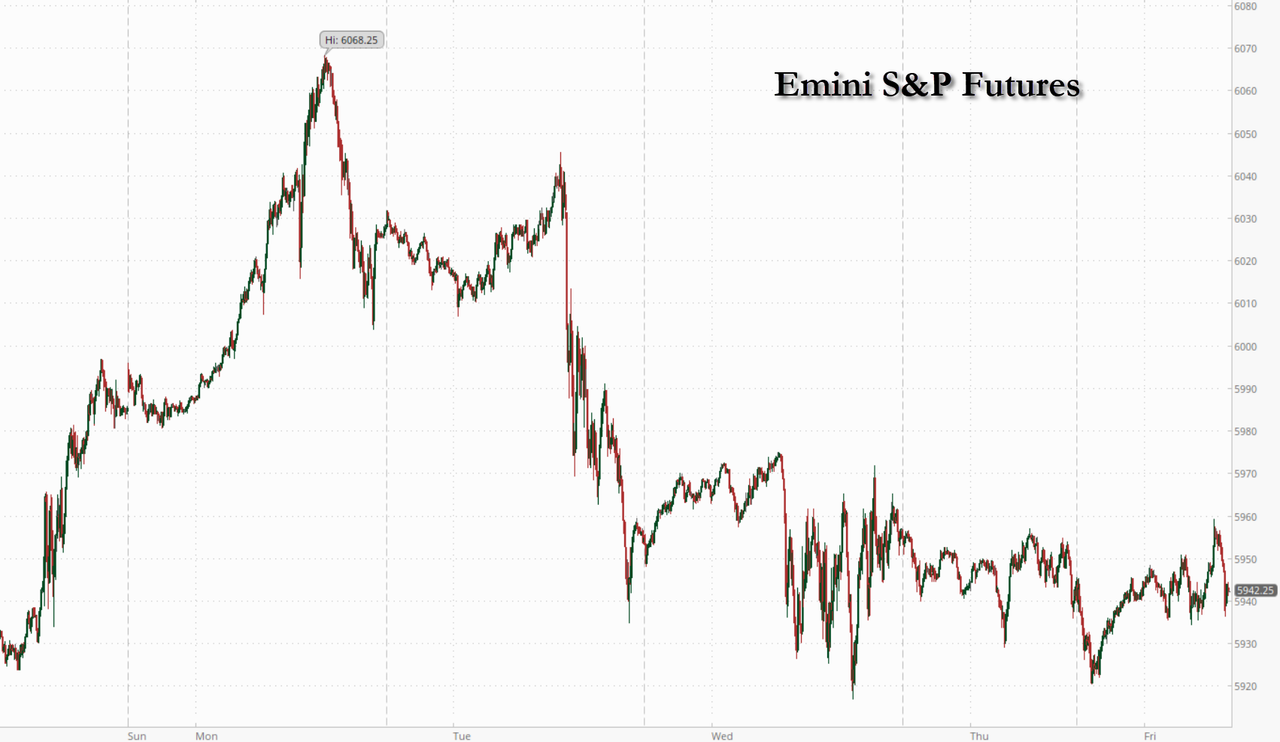

(Click on image to enlarge) plunged to 5880.20 in the overnight session, then bounced. It is currently consolidating near 5900.00 as it awaits the . Here is a to the report. All signs point to a miss. The Cycles Model does not exhibit strength in the decline yet, but the SPX is clearly beneath the 50-day Moving Average at 5946.82, showing a technical sell signal. The 100-day Moving Average lies at 5618.50 with the 1-year trendline near 5600.00.Most analysts view the latter as the “must hold” level. The Cycles Model suggests the the decline may last through the first week of February with the 1987 trendline at 5350.00 being the initial target.Today’s options chain shows Max pain at 5915.00. Long gamma may begin at 5950.00 while short gamma may strengthen beneath 5900.00. reports, “US equity futures are lower as traders took a cautious stance ahead of US jobs data that will offer fresh insight on the state of the economy. As of 8:00am, S&P 500 and Nasdaq 100 futures fell 0.2%, while in China stocks pushed toward a fresh bear market. Europe’s Stoxx 600 was little changed. Bond yields are largely unchanged, with the 10Y trading at 4.69%; while the week’s broad pullback in European government bonds persisted, pushing the yield on 10-year gilts remaining stuck near the highest level since 2008. Commodities are higher led by 2.3% gain in oil and 1.6% gain in aluminum. All eyes on NFP release today as equities continue to weigh on bond markets reaction. Consensus expects 165k jobs being added, with the unemployment rate unchanged at 4.2% (average hourly earnings are expected to rise +0.3% MoM and +4.0% YoY). In addition, Q4 earnings will begin today with DAL, STZ and WBA all reporting today. We will also receive the decision on TikTok’s SCOTUS hearing. Power utility Edison International and major US insurers slid in premarket trading as estimates of wildfire-related damages in Los Angeles soared.”(Click on image to enlarge)

plunged to 5880.20 in the overnight session, then bounced. It is currently consolidating near 5900.00 as it awaits the . Here is a to the report. All signs point to a miss. The Cycles Model does not exhibit strength in the decline yet, but the SPX is clearly beneath the 50-day Moving Average at 5946.82, showing a technical sell signal. The 100-day Moving Average lies at 5618.50 with the 1-year trendline near 5600.00.Most analysts view the latter as the “must hold” level. The Cycles Model suggests the the decline may last through the first week of February with the 1987 trendline at 5350.00 being the initial target.Today’s options chain shows Max pain at 5915.00. Long gamma may begin at 5950.00 while short gamma may strengthen beneath 5900.00. reports, “US equity futures are lower as traders took a cautious stance ahead of US jobs data that will offer fresh insight on the state of the economy. As of 8:00am, S&P 500 and Nasdaq 100 futures fell 0.2%, while in China stocks pushed toward a fresh bear market. Europe’s Stoxx 600 was little changed. Bond yields are largely unchanged, with the 10Y trading at 4.69%; while the week’s broad pullback in European government bonds persisted, pushing the yield on 10-year gilts remaining stuck near the highest level since 2008. Commodities are higher led by 2.3% gain in oil and 1.6% gain in aluminum. All eyes on NFP release today as equities continue to weigh on bond markets reaction. Consensus expects 165k jobs being added, with the unemployment rate unchanged at 4.2% (average hourly earnings are expected to rise +0.3% MoM and +4.0% YoY). In addition, Q4 earnings will begin today with DAL, STZ and WBA all reporting today. We will also receive the decision on TikTok’s SCOTUS hearing. Power utility Edison International and major US insurers slid in premarket trading as estimates of wildfire-related damages in Los Angeles soared.”(Click on image to enlarge) (Click on image to enlarge)

(Click on image to enlarge) are hovering just beneath the high at 19.50. A breakout may propel the VIX above the December high at 28.32.The January 15 options chain shows Short gamma residing between 15.00 and 16.00. Long gamma is sparse thus far, with a solitary cluster of calls at 30.00.(Click on image to enlarge)

are hovering just beneath the high at 19.50. A breakout may propel the VIX above the December high at 28.32.The January 15 options chain shows Short gamma residing between 15.00 and 16.00. Long gamma is sparse thus far, with a solitary cluster of calls at 30.00.(Click on image to enlarge) leaped to 46.93 this morning on the news, testing the Cycle Top resistance at 47.99. This may complete the current Master Cycle, as previously discussed. The Cycles Model calls for a possible 3-week decline to relieve the overbought condition. A likely target may be the mid-Cycle support at 42.22. observes, “Look out above… for yieldsThe headlines look very strong.

leaped to 46.93 this morning on the news, testing the Cycle Top resistance at 47.99. This may complete the current Master Cycle, as previously discussed. The Cycles Model calls for a possible 3-week decline to relieve the overbought condition. A likely target may be the mid-Cycle support at 42.22. observes, “Look out above… for yieldsThe headlines look very strong.

I continue to believe that seasonal adjustment factors overstate data this time of the year (our main reason for thinking we would get a strong report), but in any case markets will have to react to this data.”Analysis For January 5, 2025 Happy New Year AnalysisUS Stocks Reset Record Highs Overnight