Asian equities advanced Thursday after stocks and bonds rose on Wall Street in a week marred by tariffs, lackluster tech earnings, and uneven US economic data.Shares in Australia, Japan, and South Korea rose, while equity futures for Hong Kong also advanced.US stocks rallied on Wednesday, pushing the major averages higher for the second day in a row, as investors looked past the trade turmoil that weighed on the market earlier in the week.Here’s a table showing how US stocks performed on Wednesday:

Source: EquitymasterAt present, the BSE Sensex is trading 106 points lower and NSE Nifty is trading 38 points lower.BPCL, Cipla, and Bajaj Finance are among the top gainers today.Trent, Tita,n and Tata Steel on other hand are among the top losers today.The BSE Midcap index and the BSE Smallcap index are trading 0.3% lower.Sectoral indices are trading mixed today with stocks in the energy sector and IT sector witnessing buying. Meanwhile, stocks in the realty sector, auto sector, and banking sector witnessing selling pressure.The rupee is trading at Rs 87.55 against the US dollar.

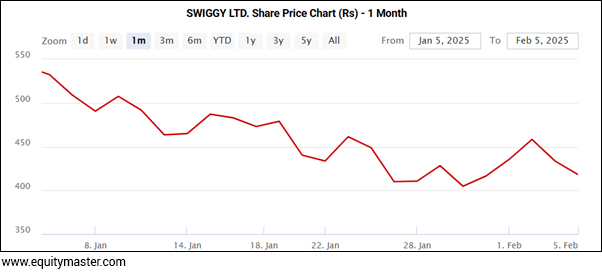

Swiggy Q3 Net Loss WidensFood delivery platform Swiggy Ltd reported a 39% YoY increase in net loss, reaching Rs 7.9 bn in the quarter ended 31 December 2024, as per regulatory filings. This compares to a net loss of Rs 5.7 bn in the same period last year.Swiggy’s revenue from operations grew 31% YoY to Rs 39.9 bn in Q3FY25, up from Rs 30.5 bn in Q3FY24.Swiggy’s results come as its rival Zomato also reported a 57% YoY decline in profits to Rs 0.6 bn in Q3. The Gurugram-based company, however, saw its revenue from operations surge 64% YoY to Rs 54 bn, up from Rs 32.9 bn a year ago. Despite this growth, Zomato had previously raised concerns over a slowdown in the food delivery segment.The company’s offerings include food delivery, grocery and household item delivery (Instamart), restaurant reservations (Dineout), event bookings (SteppinOut), product pick-up/drop-off services (Genie), and other hyperlocal commerce activities (Swiggy Minis). Cummins Q3 Profit Jumps 13%Power solutions technology provider Cummins India Ltd reported a 13% YoY rise in standalone net profit to Rs 5.1 bn for the quarter ended 31 December 2024, surpassing market expectations. This compares to a net profit of Rs 4.6 bn in Q3FY24.Standalone revenue grew 21.8% YoY to Rs 30.9 bn, up from Rs 25.3 bn in the same quarter last year. The EBITDA margin stood at 19.4% in Q3FY25, compared to 21.2% in the previous fiscal. EBITDA refers to earnings before interest, tax, depreciation, and amortization.The board of directors approved an interim dividend of Rs 18 (900%) per equity share on 277.2 mn equity shares with a face value of Rs 2 each for FY25. The record date is set for 14 February, and the interim dividend will be paid by 3 March 2025.

Cummins Q3 Profit Jumps 13%Power solutions technology provider Cummins India Ltd reported a 13% YoY rise in standalone net profit to Rs 5.1 bn for the quarter ended 31 December 2024, surpassing market expectations. This compares to a net profit of Rs 4.6 bn in Q3FY24.Standalone revenue grew 21.8% YoY to Rs 30.9 bn, up from Rs 25.3 bn in the same quarter last year. The EBITDA margin stood at 19.4% in Q3FY25, compared to 21.2% in the previous fiscal. EBITDA refers to earnings before interest, tax, depreciation, and amortization.The board of directors approved an interim dividend of Rs 18 (900%) per equity share on 277.2 mn equity shares with a face value of Rs 2 each for FY25. The record date is set for 14 February, and the interim dividend will be paid by 3 March 2025.

Welspun Corporation Q3 Profit DoublesWelspun Corp Ltd reported a 127% YoY surge in net profit to Rs 6.7 bn for the quarter ended 31 December 2024, compared to Rs 2.9 bn in Q3FY24.However, revenue from operations declined 23.9% YoY to Rs 36.1 bn, down from Rs 47.5 bn in the same quarter last year. EBITDA fell 6.1% YoY to Rs 4.3 bn, compared to Rs 4.6 bn in Q3FY24, while the EBITDA margin improved to 12% from 9.8% YoY. EBITDA refers to earnings before interest, tax, depreciation, and amortization.The board has approved the sale of 1,900 equity shares (19% stake) in Welassure Private Limited to Rakshak Securitas Private Limited, a non-related party. Additionally, the board has sanctioned an investment of up to Rs 2.5 bn in its subsidiary, Welspun Specialty Solutions Limited (WSSL), to subscribe to its rights issue, which will proceed upon WSSL issuing the letter of offer.

Azad Engineering’s Long-Term Rolls-Royce DealHyderabad-based Azad Engineering Ltd announced on 5 February that it has signed a long-term agreement with Rolls-Royce PLC, London, to manufacture and supply critical civil aircraft engine components.Under this agreement, Azad Engineering will produce highly complex machined parts in India, supporting the entire lifecycle of the engine program. This deal further strengthens the ongoing collaboration between the two companies, highlighting their shared commitment to aerospace manufacturing, precision engineering, and innovation.This milestone marks a significant step in their partnership, reinforcing both organizations’ dedication to advancing civil aircraft engine technology through cutting-edge manufacturing and engineering expertise.Sensex Today Ends 313 Points Lower; Nifty Below 23,700Sensex Today Trades Flat; Nifty Above 23,750Sensex Today Rallies 1,397 Points; Nifty Above 23,700