Today I wanted to find some large cap stocks that were breaking out of their trading patterns. I used Barchart to sort the S&P 500 Large Cap Stock Index for the stocks having the most frequent advances in the last month then used the Flipchart feature to review the charts.

Today’s list includes Affiliated Managers Group (NYSE:AMG), EOG Resources (NYSE:EOG), Abbvie (NYSE:ABBV), Invesco (IVZ) and Lyondellbasel Industries (NYSE:LYB).

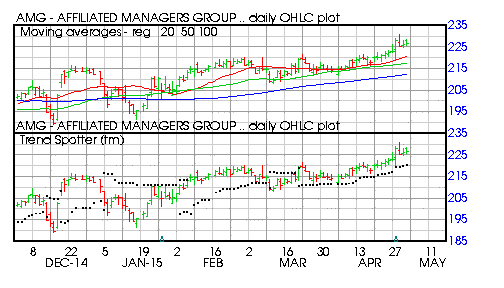

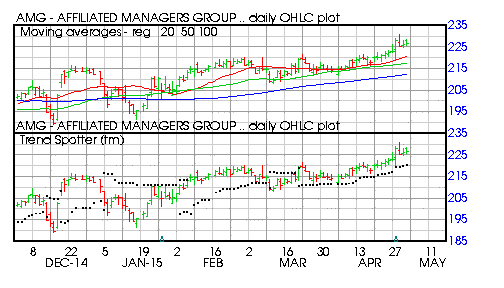

Affiliated Managers Group

Barchart technical indicators:

96% Barchart technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

15 new highs and up 5.58% in the last month

Relative Strength Index 65.80

Barchart computes a technical support level at 223.72

Recently traded at 226.45 with a 50 day moving average of 217.38

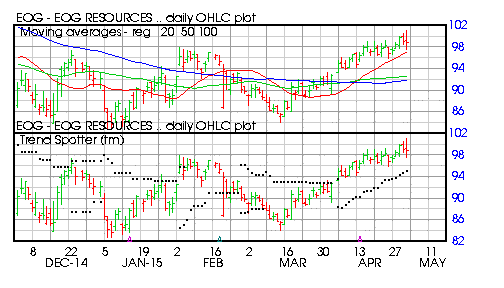

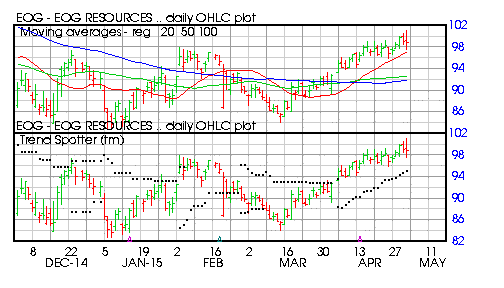

EOG Resources

Barchart technical indicators:

88% Barchart technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

14 new highs and up 8.4% in the last month

Relative Strength Index 61.54%

Barchart computes a technical support level at 95.78

Recently traded at 98.90 with a 50 day moving average of 92.61

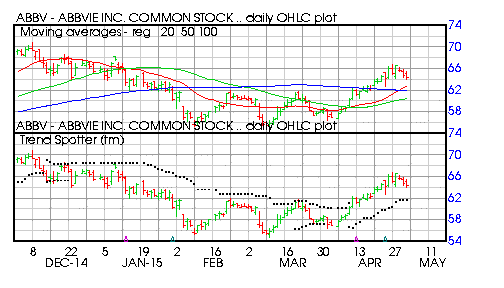

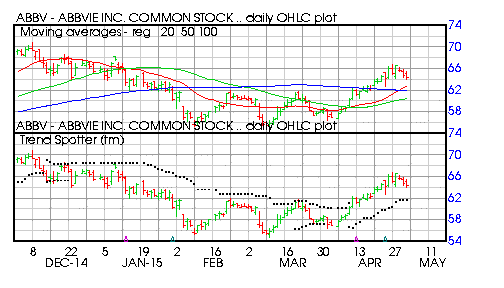

Abbvie

Barchart technical indicators:

40% Barchart technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

13 new highs and 14.82% in the last month

Relative Strength Index 62.48%

Barchart computes a technical support level at 62.95

Recently traded at 65.40 with a 50 day moving average of 60.5

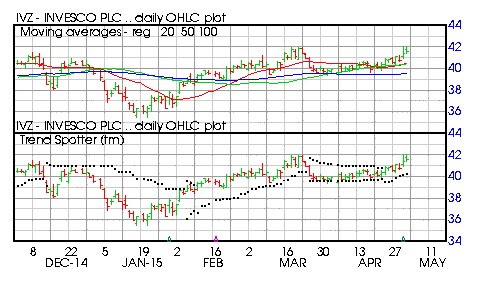

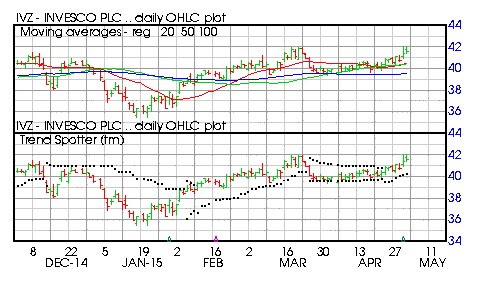

Invesco

Barcart technical indicators:

100% Barchart technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

13 new highs and up 4.60% in the last month

Relative Strength Index 62.00%

Barchart computes a technical support level at 41.02

Recently traded at 41.61 with a 50 day moving average of 40.42

Lyondellbasel Industries