Image Source:

Image Source:

Dividends are a welcome sign for dividend investors.And dividend growth is even more appreciated.When a stock’s dividend per share is increased, shareholders get a boost to their passive income – without lifting a finger.Dividend growth is measured in:

All other things being equal, longer streaks and greater percentage increases are preferred.Longer streaks are preferred because they show a company can increase dividends over a wide range of economic and competitive environments. They show evidence of a durable competitive advantage. It’s no small feat to boost a dividend year-after-year for decades at a time, through recessions, wars, and epidemics.Greater percentage dividend increases are preferred because they show that the company is willing and able to pay more to shareholders. This is a sign management expects cash flow growth and stability on a per share basis.With all this in mind, we created a list of all 66 Dividend Aristocrats, a group of stocks in the S&P 500 Index, with 25+ years of dividend increases.And since dividends are paid with actual cash, they can’t be faked. A company cannot pay dividends out of fictional earnings.A company cannot pay dividends for any meaningful length of time without generating cash flows to support the dividend.Dividend growth is a powerful signal of a company’s financial health, management’s confidence, and commitment to long-term value creation.The following list is comprised of the 10 best dividend stocks using the dividend growth signal.These 10 Dividend Aristocrats were chosen based on their projected future 5-year annual earnings-per-share growth in the Sure Analysis Research Database.The stocks are ranked by 5-year expected EPS growth rates, from lowest to highest.

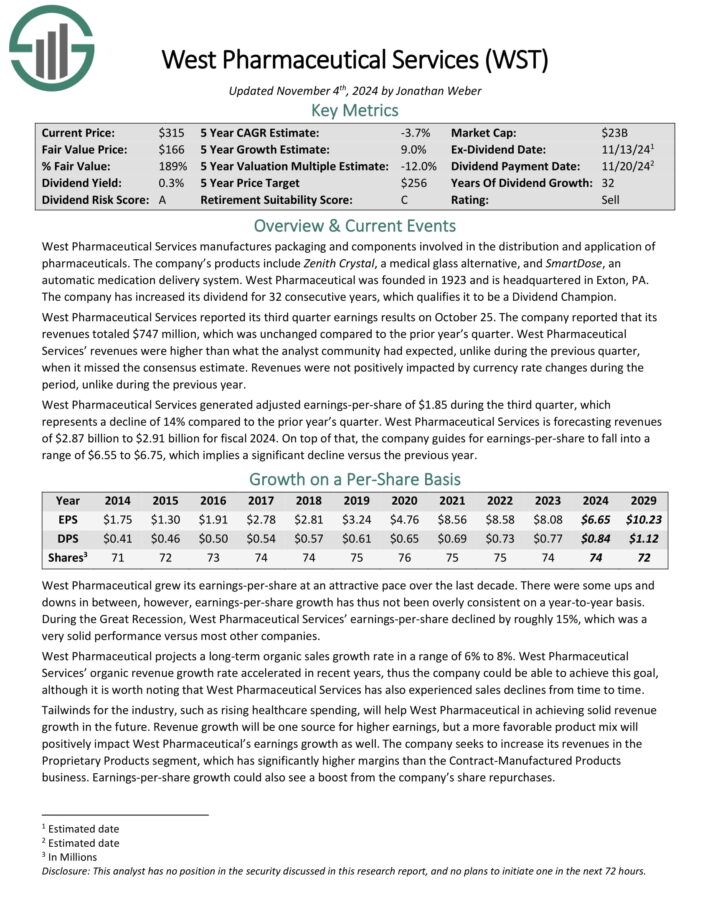

Best Stock Using the Dividend Growth Signal: West Pharmaceutical Services (WST)

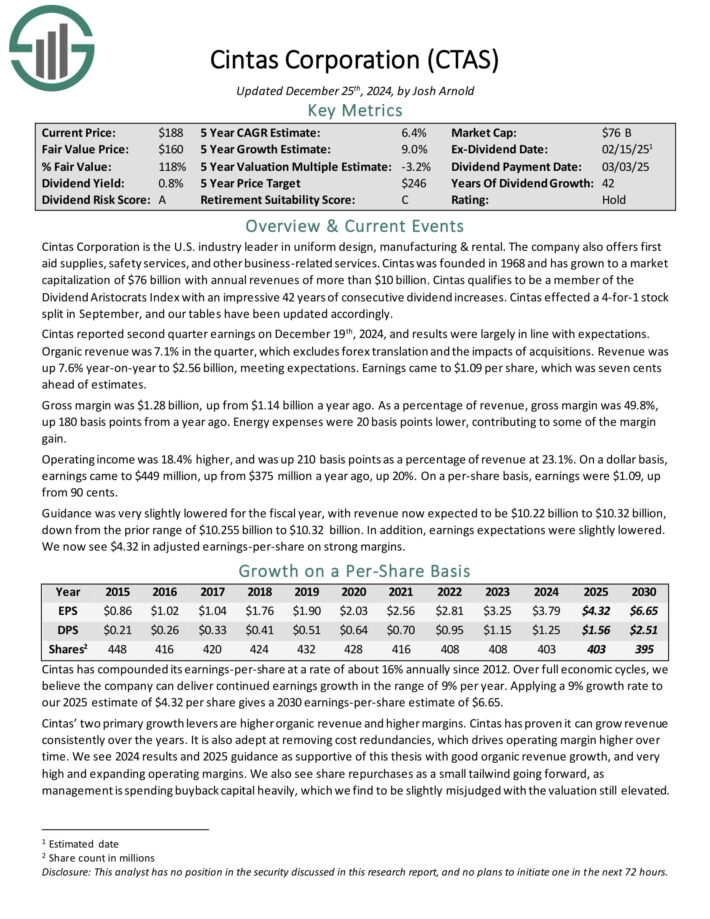

West Pharmaceutical Services manufactures packaging and components involved in the distribution and application of pharmaceuticals. The company’s products include Zenith Crystal, a medical glass alternative, and SmartDose, an automatic medication delivery system.West Pharmaceutical Services reported its second quarter earnings results on July 25. The company reported that its revenues totaled $702 million, which represents a revenue decline of 7% compared to the prior year’s quarter.West Pharmaceutical Services’ revenues were lower than what the analyst community had expected, unlike during the previous quarter, when it beat the consensus estimate. Revenues were not positively impacted by currency rate changes during the period, unlike during the previous year.West Pharmaceutical Services generated adjusted earnings-per-share of $1.52 during the second quarter, which represents a decline of 28% compared to the prior year’s quarter. to download our most recent Sure Analysis report on WST (preview of page 1 of 3 shown below): Best Stock Using the Dividend Growth Signal: Cintas Corporation (CTAS)Cintas Corporation is the U.S. industry leader in uniform design, manufacturing & rental. The company also offers first aid supplies, safety services, and other business-related services.Cintas reported second quarter earnings on December 19th, 2024, and results were largely in line with expectations. Organic revenue was 7.1% in the quarter, which excludes forex translation and the impacts of acquisitions.Revenue was up 7.6% year-on-year to $2.56 billion, meeting expectations. Earnings came to $1.09 per share, which was seven cents ahead of estimates.Gross margin was $1.28 billion, up from $1.14 billion a year ago. As a percentage of revenue, gross margin was 49.8%, up 180 basis points from a year ago. Energy expenses were 20 basis points lower, contributing to some of the margin gain.Operating income was 18.4% higher, and was up 210 basis points as a percentage of revenue at 23.1%. On a dollar basis, earnings came to $449 million, up from $375 million a year ago, up 20%. On a per-share basis, earnings were $1.09, up from 90 cents. to download our most recent Sure Analysis report on CTAS (preview of page 1 of 3 shown below):

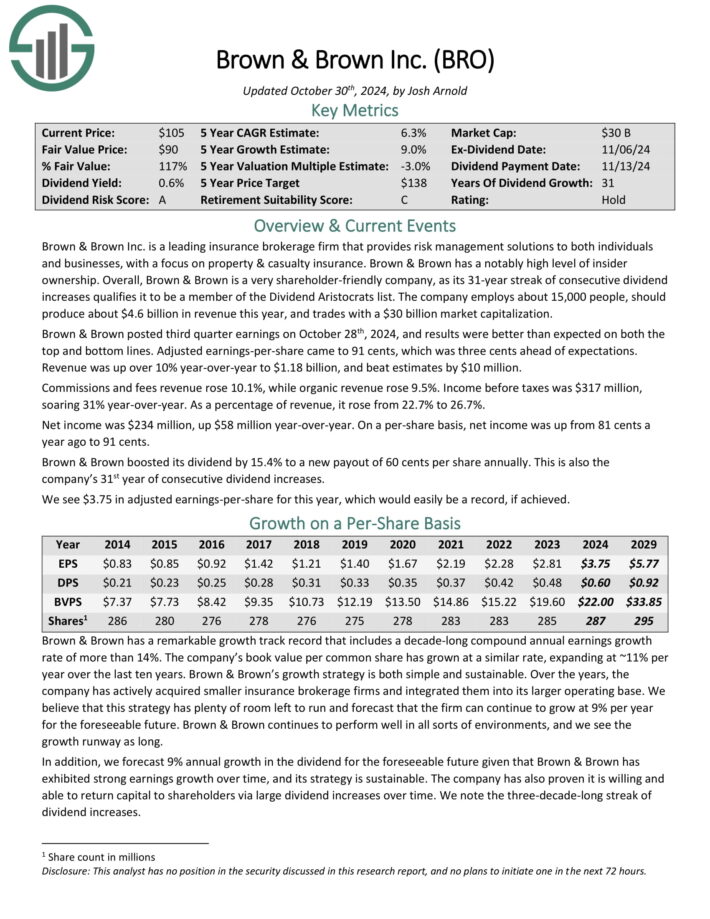

Best Stock Using the Dividend Growth Signal: Cintas Corporation (CTAS)Cintas Corporation is the U.S. industry leader in uniform design, manufacturing & rental. The company also offers first aid supplies, safety services, and other business-related services.Cintas reported second quarter earnings on December 19th, 2024, and results were largely in line with expectations. Organic revenue was 7.1% in the quarter, which excludes forex translation and the impacts of acquisitions.Revenue was up 7.6% year-on-year to $2.56 billion, meeting expectations. Earnings came to $1.09 per share, which was seven cents ahead of estimates.Gross margin was $1.28 billion, up from $1.14 billion a year ago. As a percentage of revenue, gross margin was 49.8%, up 180 basis points from a year ago. Energy expenses were 20 basis points lower, contributing to some of the margin gain.Operating income was 18.4% higher, and was up 210 basis points as a percentage of revenue at 23.1%. On a dollar basis, earnings came to $449 million, up from $375 million a year ago, up 20%. On a per-share basis, earnings were $1.09, up from 90 cents. to download our most recent Sure Analysis report on CTAS (preview of page 1 of 3 shown below): Best Stock Using the Dividend Growth Signal: Brown & Brown Inc. (BRO)Brown & Brown Inc. is a leading insurance brokerage firm that provides risk management solutions to both individuals and businesses, with a focus on property & casualty insurance. Brown & Brown has a notably high level of insider ownership.Brown & Brown posted third quarter earnings on October 28th, 2024, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to 91 cents, which was three cents ahead of expectations.Revenue was up over 10% year-over-year to $1.18 billion, and beat estimates by $10 million. Commissions and fees revenue rose 10.1%, while organic revenue rose 9.5%. Income before taxes was $317 million, soaring 31% year-over-year. As a percentage of revenue, it rose from 22.7% to 26.7%.Net income was $234 million, up $58 million year-over-year. On a per-share basis, net income was up from 81 cents a year ago to 91 cents. Brown & Brown boosted its dividend by 15.4% to a new payout of 60 cents per share annually. This is also the company’s 31st year of consecutive dividend increases.Its competitive advantage comes from its willingness to execute small and frequent acquisitions. This growth-by-acquisition strategy gives the company an enduring opportunity to continue growing its business for the foreseeable future. to download our most recent Sure Analysis report on BRO (preview of page 1 of 3 shown below):

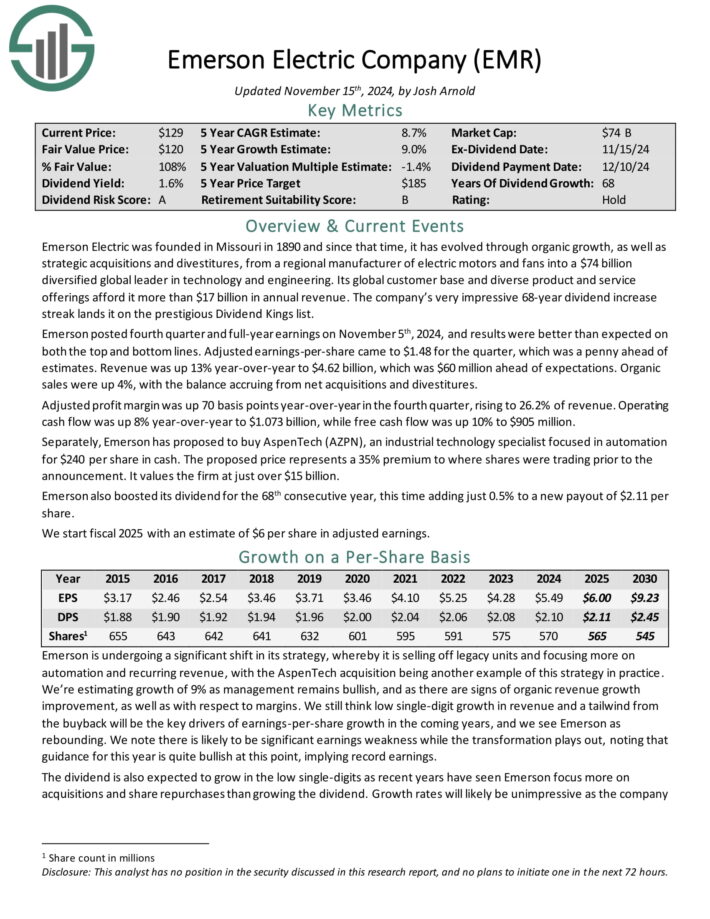

Best Stock Using the Dividend Growth Signal: Brown & Brown Inc. (BRO)Brown & Brown Inc. is a leading insurance brokerage firm that provides risk management solutions to both individuals and businesses, with a focus on property & casualty insurance. Brown & Brown has a notably high level of insider ownership.Brown & Brown posted third quarter earnings on October 28th, 2024, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to 91 cents, which was three cents ahead of expectations.Revenue was up over 10% year-over-year to $1.18 billion, and beat estimates by $10 million. Commissions and fees revenue rose 10.1%, while organic revenue rose 9.5%. Income before taxes was $317 million, soaring 31% year-over-year. As a percentage of revenue, it rose from 22.7% to 26.7%.Net income was $234 million, up $58 million year-over-year. On a per-share basis, net income was up from 81 cents a year ago to 91 cents. Brown & Brown boosted its dividend by 15.4% to a new payout of 60 cents per share annually. This is also the company’s 31st year of consecutive dividend increases.Its competitive advantage comes from its willingness to execute small and frequent acquisitions. This growth-by-acquisition strategy gives the company an enduring opportunity to continue growing its business for the foreseeable future. to download our most recent Sure Analysis report on BRO (preview of page 1 of 3 shown below): Best Stock Using the Dividend Growth Signal: Emerson Electric Co. (EMR)Emerson Electric is a diversified global leader in technology and engineering. Its global customer base and diverse product and service offerings afford it more than $17 billion in annual revenue.Emerson posted fourth quarter and full-year earnings on November 5th, 2024, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $1.48 for the quarter, which was a penny ahead of estimates.Revenue was up 13% year-over-year to $4.62 billion, which was $60 million ahead of expectations. Organicsales were up 4%, with the balance accruing from net acquisitions and divestitures.Adjusted profit margin was up 70 basis points year-over-year in the fourth quarter, rising to 26.2% of revenue. Operating cash flow was up 8% year-over-year to $1.073 billion, while free cash flow was up 10% to $905 million.Emerson also boosted its dividend for the 68th consecutive year. to download our most recent Sure Analysis report on EMR (preview of page 1 of 3 shown below):

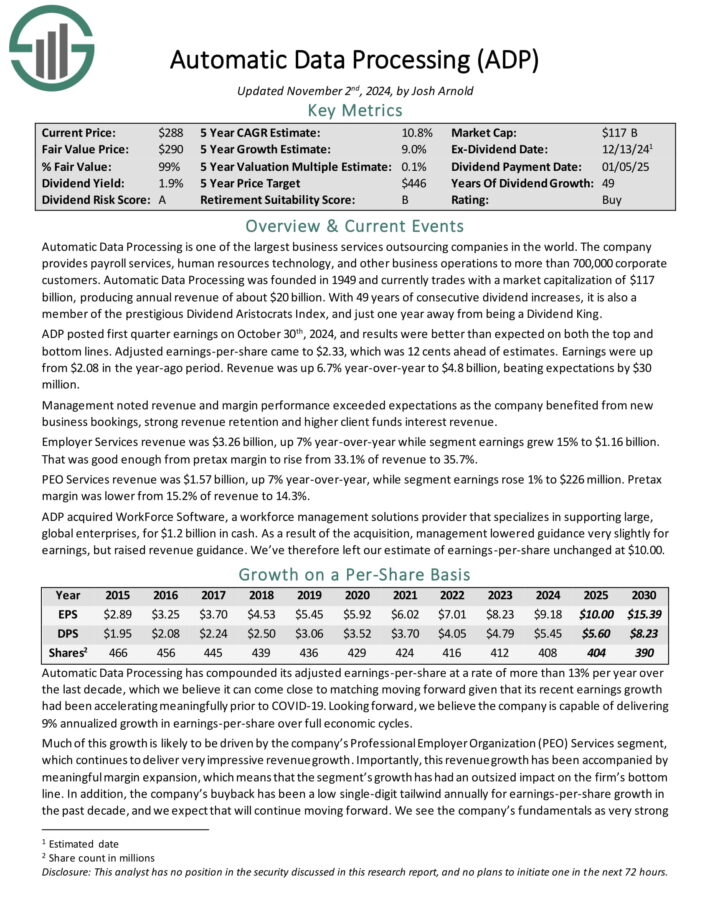

Best Stock Using the Dividend Growth Signal: Emerson Electric Co. (EMR)Emerson Electric is a diversified global leader in technology and engineering. Its global customer base and diverse product and service offerings afford it more than $17 billion in annual revenue.Emerson posted fourth quarter and full-year earnings on November 5th, 2024, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $1.48 for the quarter, which was a penny ahead of estimates.Revenue was up 13% year-over-year to $4.62 billion, which was $60 million ahead of expectations. Organicsales were up 4%, with the balance accruing from net acquisitions and divestitures.Adjusted profit margin was up 70 basis points year-over-year in the fourth quarter, rising to 26.2% of revenue. Operating cash flow was up 8% year-over-year to $1.073 billion, while free cash flow was up 10% to $905 million.Emerson also boosted its dividend for the 68th consecutive year. to download our most recent Sure Analysis report on EMR (preview of page 1 of 3 shown below): Best Stock Using the Dividend Growth Signal: Automatic Data Processing, Inc. (ADP)Automatic Data Processing is one of the largest business services outsourcing companies in the world. The company provides payroll services, human resources technology, and other business operations to more than 700,000 corporate customers.ADP posted first quarter earnings on October 30th, 2024, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $2.33, which was 12 cents ahead of estimates.Earnings were up from $2.08 in the year-ago period. Revenue was up 6.7% year-over-year to $4.8 billion, beating expectations by $30 million.Management noted revenue and margin performance exceeded expectations as the company benefited from new business bookings, strong revenue retention and higher client funds interest revenue.Employer Services revenue was $3.26 billion, up 7% year-over-year while segment earnings grew 15% to $1.16 billion. That was good enough from pretax margin to rise from 33.1% of revenue to 35.7%. to download our most recent Sure Analysis report on ADP (preview of page 1 of 3 shown below):

Best Stock Using the Dividend Growth Signal: Automatic Data Processing, Inc. (ADP)Automatic Data Processing is one of the largest business services outsourcing companies in the world. The company provides payroll services, human resources technology, and other business operations to more than 700,000 corporate customers.ADP posted first quarter earnings on October 30th, 2024, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $2.33, which was 12 cents ahead of estimates.Earnings were up from $2.08 in the year-ago period. Revenue was up 6.7% year-over-year to $4.8 billion, beating expectations by $30 million.Management noted revenue and margin performance exceeded expectations as the company benefited from new business bookings, strong revenue retention and higher client funds interest revenue.Employer Services revenue was $3.26 billion, up 7% year-over-year while segment earnings grew 15% to $1.16 billion. That was good enough from pretax margin to rise from 33.1% of revenue to 35.7%. to download our most recent Sure Analysis report on ADP (preview of page 1 of 3 shown below): Best Stock Using the Dividend Growth Signal: Roper Technologies (ROP)Roper Technologies is a specialized industrial company that manufactures products such as medical and scientific imaging equipment, pumps, and material analysis equipment.Roper Technologies also develops software solutions for the healthcare, transportation, food, energy, and water industries. The company was founded in 1981, generatesaround $5.4 billion in annual revenues, and is based in Sarasota, Florida.On October 23rd, 2024, Roper posted its Q3 results for the period ending September 30th, 2024. Quarterly revenues and adjusted EPS were $1.76 billion and $4.62, indicating a year-over-year increase of 13% and 7%, respectively.The company’s momentum during the quarter remained strong, with organic growth coming in at 4% and acquisitions further boosting top-line growth.Organic growth was once again driven by broad-based strength across its portfolio of niche-leading businesses. to download our most recent Sure Analysis report on ROP (preview of page 1 of 3 shown below):

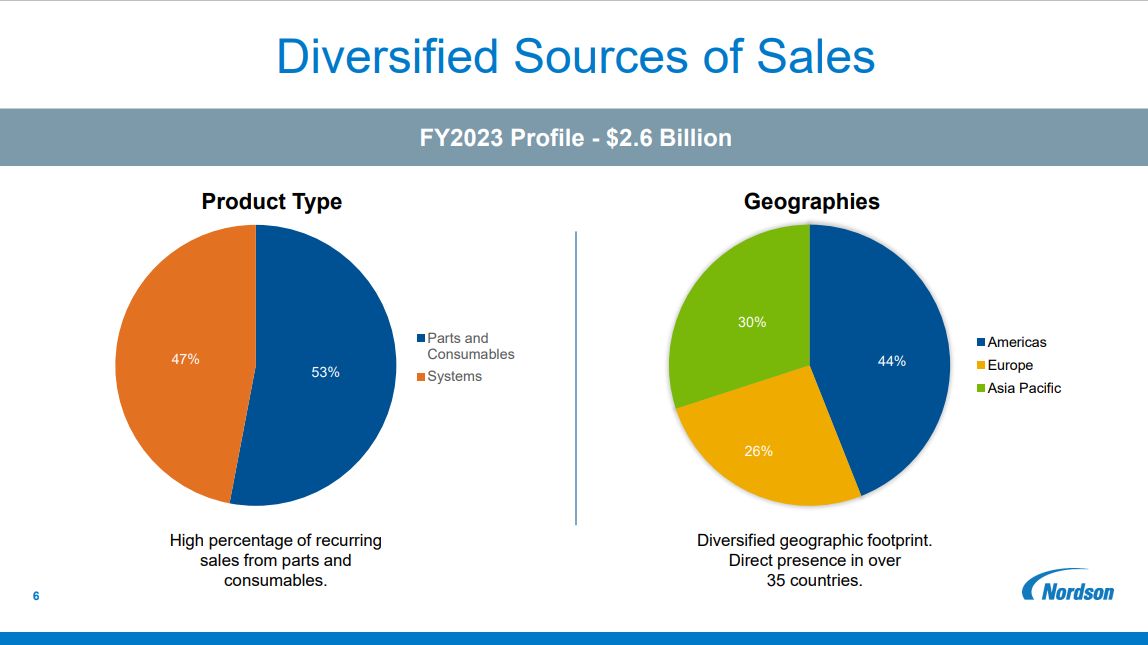

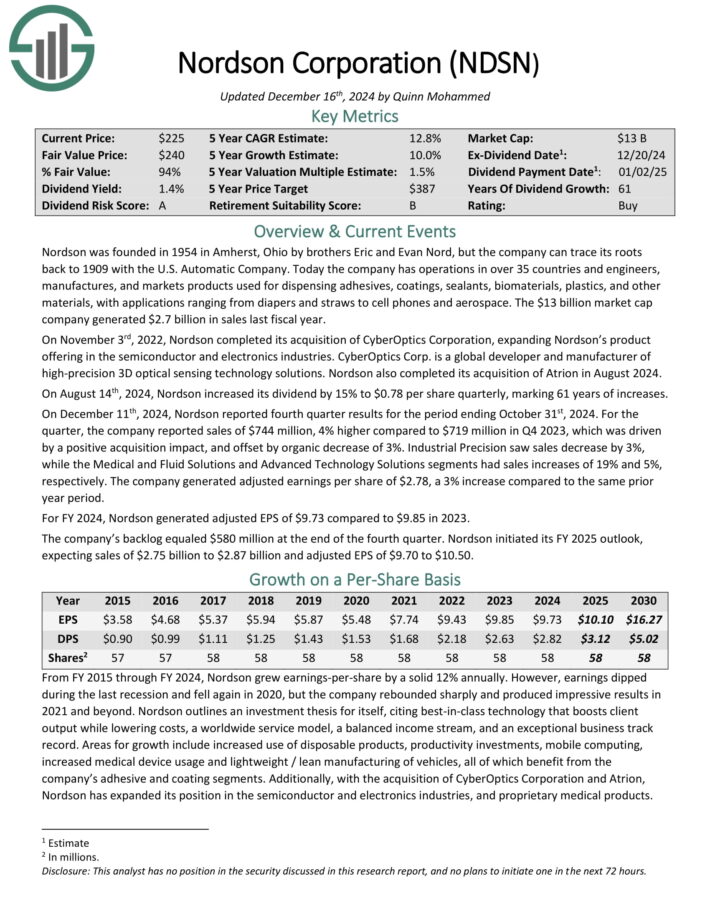

Best Stock Using the Dividend Growth Signal: Roper Technologies (ROP)Roper Technologies is a specialized industrial company that manufactures products such as medical and scientific imaging equipment, pumps, and material analysis equipment.Roper Technologies also develops software solutions for the healthcare, transportation, food, energy, and water industries. The company was founded in 1981, generatesaround $5.4 billion in annual revenues, and is based in Sarasota, Florida.On October 23rd, 2024, Roper posted its Q3 results for the period ending September 30th, 2024. Quarterly revenues and adjusted EPS were $1.76 billion and $4.62, indicating a year-over-year increase of 13% and 7%, respectively.The company’s momentum during the quarter remained strong, with organic growth coming in at 4% and acquisitions further boosting top-line growth.Organic growth was once again driven by broad-based strength across its portfolio of niche-leading businesses. to download our most recent Sure Analysis report on ROP (preview of page 1 of 3 shown below): Best Stock Using the Dividend Growth Signal: Nordson Corp. (NDSN)Nordson was founded in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, but the company can trace its roots back to 1909 with the U.S. Automatic Company.Today the company has operations in over 35 countries and engineers, manufactures, and markets products used for dispensing adhesives, coatings, sealants, biomaterials, plastics, and other materials, with applications ranging from diapers and straws to cell phones and aerospace.

Best Stock Using the Dividend Growth Signal: Nordson Corp. (NDSN)Nordson was founded in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, but the company can trace its roots back to 1909 with the U.S. Automatic Company.Today the company has operations in over 35 countries and engineers, manufactures, and markets products used for dispensing adhesives, coatings, sealants, biomaterials, plastics, and other materials, with applications ranging from diapers and straws to cell phones and aerospace. Source: On August 14th, 2024, Nordson increased its dividend by 15% to $0.78 per share quarterly, marking 61 years of increases.On December 11th, 2024, Nordson reported fourth quarter results for the period ending October 31st, 2024. For the quarter, the company reported sales of $744 million, 4% higher compared to $719 million in Q4 2023, which was driven by a positive acquisition impact, and offset by organic decrease of 3%.Industrial Precision saw sales decrease by 3%, while the Medical and Fluid Solutions and Advanced Technology Solutions segments had sales increases of 19% and 5%, respectively. The company generated adjusted earnings per share of $2.78, a 3% increase compared to the same prior-year quarter. to download our most recent Sure Analysis report on NDSN (preview of page 1 of 3 shown below):

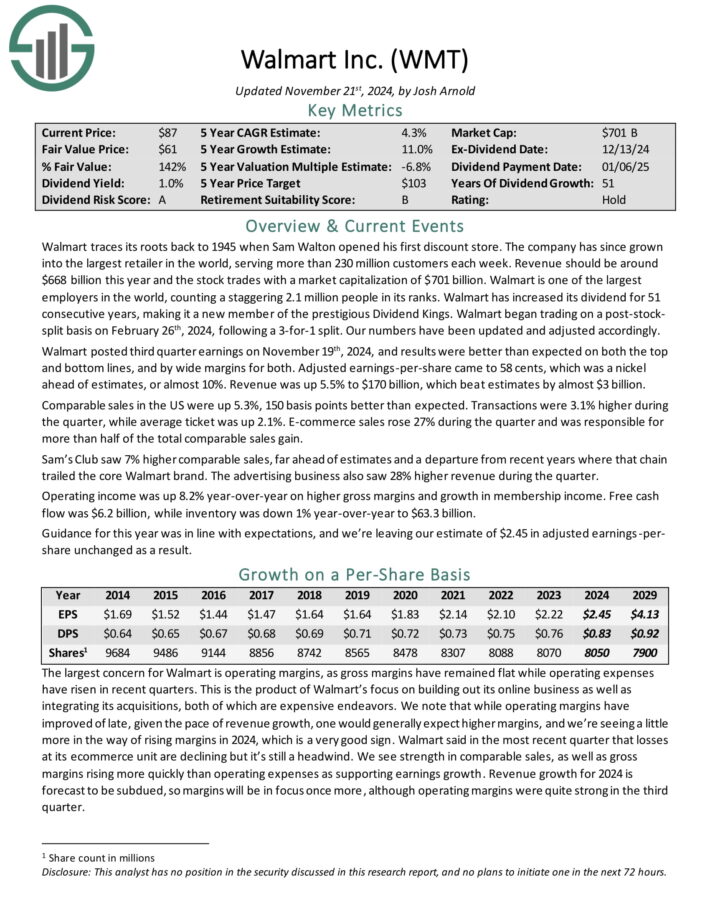

Source: On August 14th, 2024, Nordson increased its dividend by 15% to $0.78 per share quarterly, marking 61 years of increases.On December 11th, 2024, Nordson reported fourth quarter results for the period ending October 31st, 2024. For the quarter, the company reported sales of $744 million, 4% higher compared to $719 million in Q4 2023, which was driven by a positive acquisition impact, and offset by organic decrease of 3%.Industrial Precision saw sales decrease by 3%, while the Medical and Fluid Solutions and Advanced Technology Solutions segments had sales increases of 19% and 5%, respectively. The company generated adjusted earnings per share of $2.78, a 3% increase compared to the same prior-year quarter. to download our most recent Sure Analysis report on NDSN (preview of page 1 of 3 shown below): Best Stock Using the Dividend Growth Signal: Walmart Inc. (WMT)Walmart traces its roots back to 1945 when Sam Walton opened his first discount store. The company has since grown into one of the largest retailers in the world, serving over 230 million customers each week. Revenue will likely be around $600 billion this year.Walmart posted second quarter earnings on August 15th, 2024, and results were excellent, sending the stock soaring. Adjusted earnings-per-share beat estimates by two cents at 67 cents. Revenue was up almost 5% year-over-year to $169.3 billion, and beat estimates by almost $2 billion.Walmart posted third quarter earnings on November 19th, 2024, and results were better than expected on both the top and bottom lines, and by wide margins for both.Adjusted earnings-per-share came to 58 cents, which was a nickel ahead of estimates, or almost 10%. Revenue was up 5.5% to $170 billion, which beat estimates by almost $3 billion.Comparable sales in the US were up 5.3%, 150 basis points better than expected. Transactions were 3.1% higher during the quarter, while average ticket was up 2.1%.E-commerce sales rose 27% during the quarter and was responsible for more than half of the total comparable sales gain. to download our most recent Sure Analysis report on Walmart (preview of page 1 of 3 shown below):

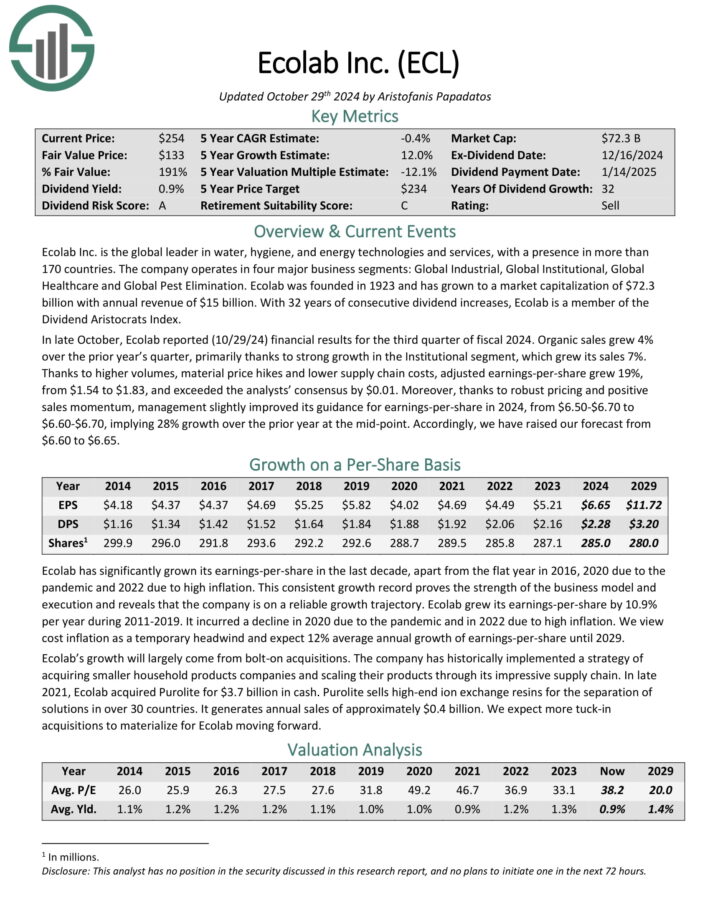

Best Stock Using the Dividend Growth Signal: Walmart Inc. (WMT)Walmart traces its roots back to 1945 when Sam Walton opened his first discount store. The company has since grown into one of the largest retailers in the world, serving over 230 million customers each week. Revenue will likely be around $600 billion this year.Walmart posted second quarter earnings on August 15th, 2024, and results were excellent, sending the stock soaring. Adjusted earnings-per-share beat estimates by two cents at 67 cents. Revenue was up almost 5% year-over-year to $169.3 billion, and beat estimates by almost $2 billion.Walmart posted third quarter earnings on November 19th, 2024, and results were better than expected on both the top and bottom lines, and by wide margins for both.Adjusted earnings-per-share came to 58 cents, which was a nickel ahead of estimates, or almost 10%. Revenue was up 5.5% to $170 billion, which beat estimates by almost $3 billion.Comparable sales in the US were up 5.3%, 150 basis points better than expected. Transactions were 3.1% higher during the quarter, while average ticket was up 2.1%.E-commerce sales rose 27% during the quarter and was responsible for more than half of the total comparable sales gain. to download our most recent Sure Analysis report on Walmart (preview of page 1 of 3 shown below): Best Stock Using the Dividend Growth Signal: Ecolab, Inc. (ECL)Ecolab Inc. is the global leader in water, hygiene, and energy technologies and services, with a presence in more than 170 countries.The company operates in four major business segments: Global Industrial, Global Institutional, Global Healthcare and Global Pest Elimination.In late October, Ecolab reported (10/29/24) financial results for the third quarter of fiscal 2024. Organic sales grew 4% over the prior year’s quarter, primarily thanks to strong growth in the Institutional segment, which grew its sales 7%.Thanks to higher volumes, material price hikes and lower supply chain costs, adjusted earnings-per-share grew 19%, from $1.54 to $1.83, and exceeded the analysts’ consensus by $0.01.Moreover, thanks to robust pricing and positive sales momentum, management slightly improved its guidance for earnings-per-share in 2024, from $6.50-$6.70 to $6.60-$6.70, implying 28% growth over the prior year at the mid-point. to download our most recent Sure Analysis report on ECL (preview of page 1 of 3 shown below):

Best Stock Using the Dividend Growth Signal: Ecolab, Inc. (ECL)Ecolab Inc. is the global leader in water, hygiene, and energy technologies and services, with a presence in more than 170 countries.The company operates in four major business segments: Global Industrial, Global Institutional, Global Healthcare and Global Pest Elimination.In late October, Ecolab reported (10/29/24) financial results for the third quarter of fiscal 2024. Organic sales grew 4% over the prior year’s quarter, primarily thanks to strong growth in the Institutional segment, which grew its sales 7%.Thanks to higher volumes, material price hikes and lower supply chain costs, adjusted earnings-per-share grew 19%, from $1.54 to $1.83, and exceeded the analysts’ consensus by $0.01.Moreover, thanks to robust pricing and positive sales momentum, management slightly improved its guidance for earnings-per-share in 2024, from $6.50-$6.70 to $6.60-$6.70, implying 28% growth over the prior year at the mid-point. to download our most recent Sure Analysis report on ECL (preview of page 1 of 3 shown below): Best Stock Using the Dividend Growth Signal: S&P Global (SPGI)S&P Global is a worldwide provider of financial services and business information and revenue of over $13 billion. Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.S&P Global has paid dividends continuously since 1937 and has increased its payout for 51 consecutive years.S&P Global posted third quarter earnings on October 24th, 2024, and results were quite strong once again. Adjusted earnings-per-share came to $3.89, which was 25 cents ahead of estimates. Earnings were down from $4.04 in Q2, but much higher than $3.21 in the year-ago period.Revenue soared 16% higher year-on-year to $3.58 billion, which also beat estimates by $150 million. Growth in the Ratings and Indices segment led the top line higher in Q3, although strength was broad. to download our most recent Sure Analysis report on SPGI (preview of page 1 of 3 shown below):

Best Stock Using the Dividend Growth Signal: S&P Global (SPGI)S&P Global is a worldwide provider of financial services and business information and revenue of over $13 billion. Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.S&P Global has paid dividends continuously since 1937 and has increased its payout for 51 consecutive years.S&P Global posted third quarter earnings on October 24th, 2024, and results were quite strong once again. Adjusted earnings-per-share came to $3.89, which was 25 cents ahead of estimates. Earnings were down from $4.04 in Q2, but much higher than $3.21 in the year-ago period.Revenue soared 16% higher year-on-year to $3.58 billion, which also beat estimates by $150 million. Growth in the Ratings and Indices segment led the top line higher in Q3, although strength was broad. to download our most recent Sure Analysis report on SPGI (preview of page 1 of 3 shown below):