Image Source:

Image Source:

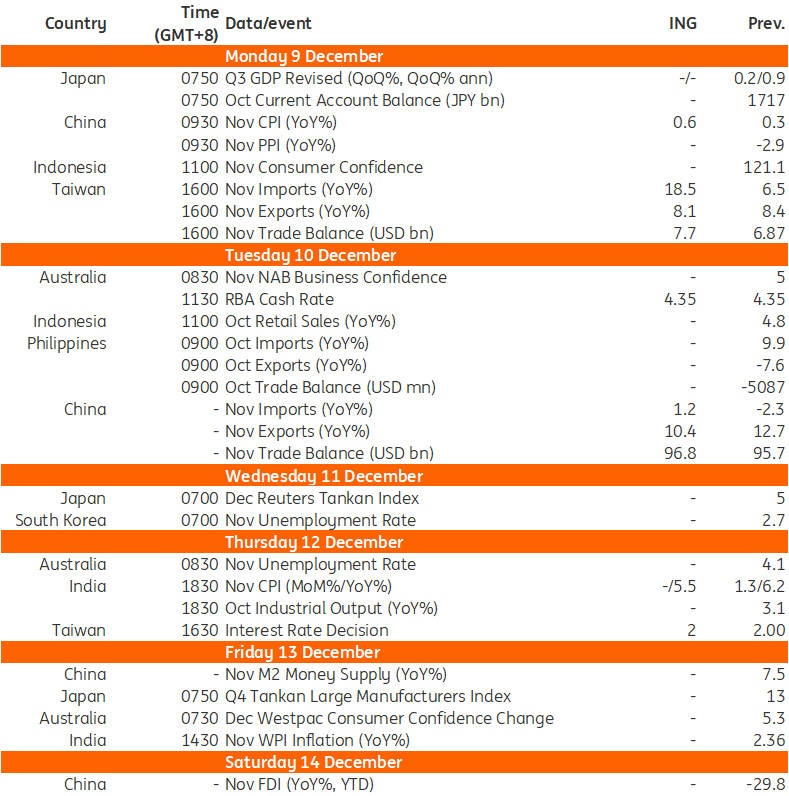

We look at what’s in store in the region next week, including China’s Central Economic Work Conference, Australia’s cash target rate, India’s inflation data, and the Japanese Tankan business survey.

Australia: RBA expected to remain on holdWe expect the Reserve Bank of Australia (RBA) to leave the cash rate unchanged at 4.35%. An elevated core inflation reading for October and stronger third-quarter GDP growth suggest that the central bank is in no rush to cut policy rates. We think the earliest the RBA will move on rates is March 2025 with a high probability of it getting pushed to the second quarter of next year.

China: Central Economic Work Conference with CPI and trade dataThe big event next week will be the annual Central Economic Work Conference. While numerical targets are not expected to be the focus – as this is typically set at the Two Sessions – it nonetheless will be the market’s next window into how policymakers approach next year. We will be watching to see if there’s any shift in tone on fiscal/monetary policy (from the current proactive/prudent stances respectively).We will also focus on what areas of the economy appear to be prioritised, with particular interest on whether we will see additional focus or new directions in terms of supporting domestic demand and the property market. Finally, shifts in tone and new phrases are worth monitoring closely as they can herald larger shifts in policy direction. We expect the markets would be satisfied with a shift to signal more aggressive policy support but may be disappointed if the release offers little new content.The conference aside, China is set to release its November CPI inflation data on Tuesday, and its trade data on Wednesday. We are looking for CPI inflation to edge up to 0.6% YoY from 0.3% YoY in October, as food prices continue to offset sluggish non-food inflation. We expect export growth to remain solid at 10.4% YoY in November, in part thanks to the front-loading of exports after Trump’s election victory. Imports on the other hand are expected to remain weak amid sluggish domestic demand at around 1.2% YoY. This would translate to a trade surplus of US$96.8bn.

India: CPI inflation should fall back within the Reserve Bank of India’s target rangeCPI inflation for November should ease to about 5.5% after the October reading hit a 14-month high of 6.21%, largely driven by lower food prices.

Japan: Tankan business surveyJapan will publish its Tankan business survey. We expect the outlook for the non-manufacturing sector to improve in the fourth quarter on the back of solid wage growth and relatively positive consumer sentiment. However, the manufacturing outlook is likely to deteriorate as uncertainty over global trade policy, particularly in the auto industry, increases.

Taiwan: export growth to adjust a little while import growth bounces backTaiwan will release its November trade data on Monday. We expect export growth to moderate slightly to around 8.1% YoY and for import growth to rebound to 18.5% YoY. The stronger import growth is largely base effect driven thanks to the contraction of imports in 2023 versus flat exports; we are still looking for the trade balance to edge up to US$7.7bn from $6.9bn.Export growth has been choppy this year and a less supportive base effect for exports in the final two months of the year could lead to some moderation of growth, but overall the external demand picture has been supportive this year.

Key events in Asia next week Source: Refinitiv, ING

Source: Refinitiv, ING