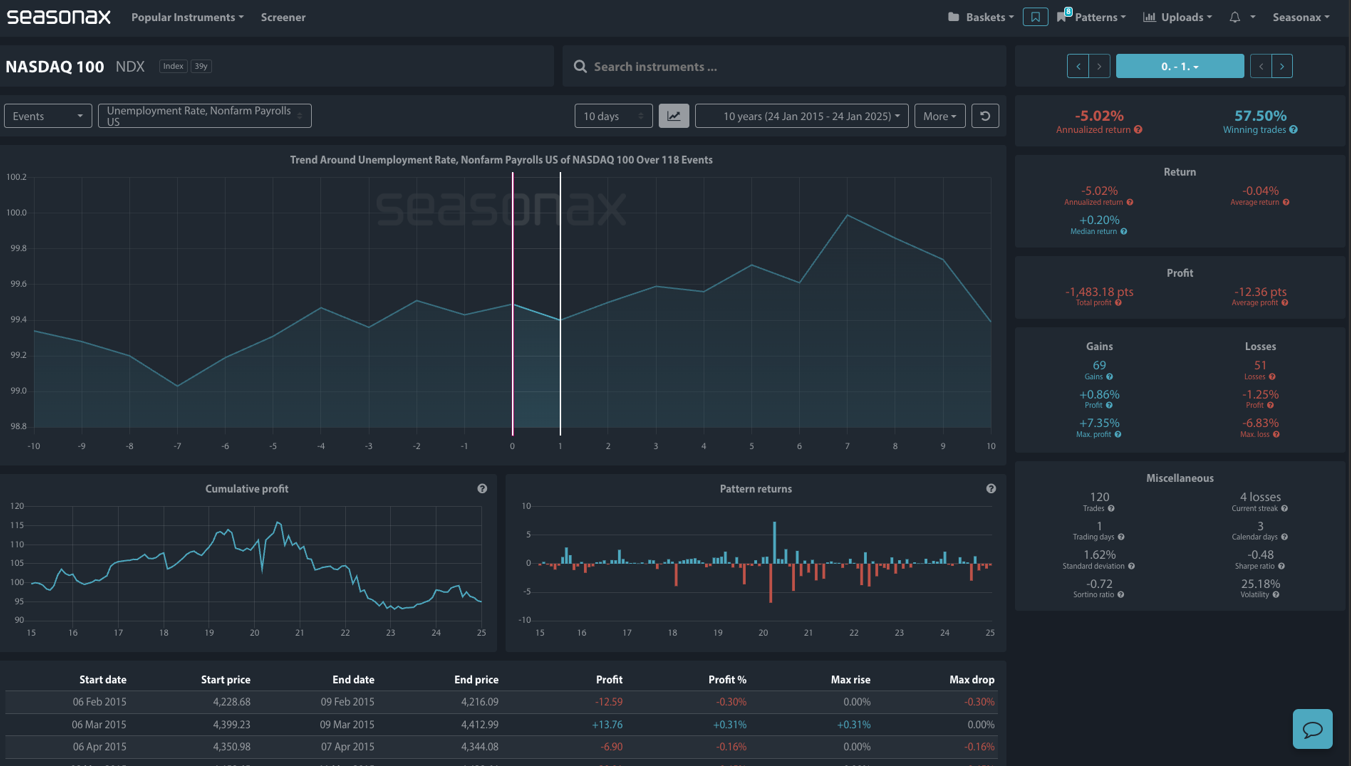

Seasonal Risk Event StrengthThe seasonal data for the Nasdaq 100 index () around Nonfarm Payrolls announcements indicates a weak historical trend, with an aggregate annualized return of -5.02%. While 57.50% of trades were winners, the losses outweighed gains, with an average return per trade of -0.04%. The largest single trade gains and losses were +7.35% and -6.83%, respectively, emphasizing a bearish bias during these events. Notably, returns tend to decline leading up to announcement days, followed by a recovery phase in the subsequent 3–5 days.This data suggests avoiding long trades before announcements due to the negative average returns and focusing on potential post-event rebounds. High volatility (25.18%) and significant downside risk highlight the importance of risk management with strict stop-loss levels. It is helpful to see that should we have a really large miss or beat in the NFP print there is potential for outsized moves in the Nasdaq, so momentum intraday traders can be prepared for quick, volatile moves.(Click on image to enlarge) Technical Perspective

Technical Perspective

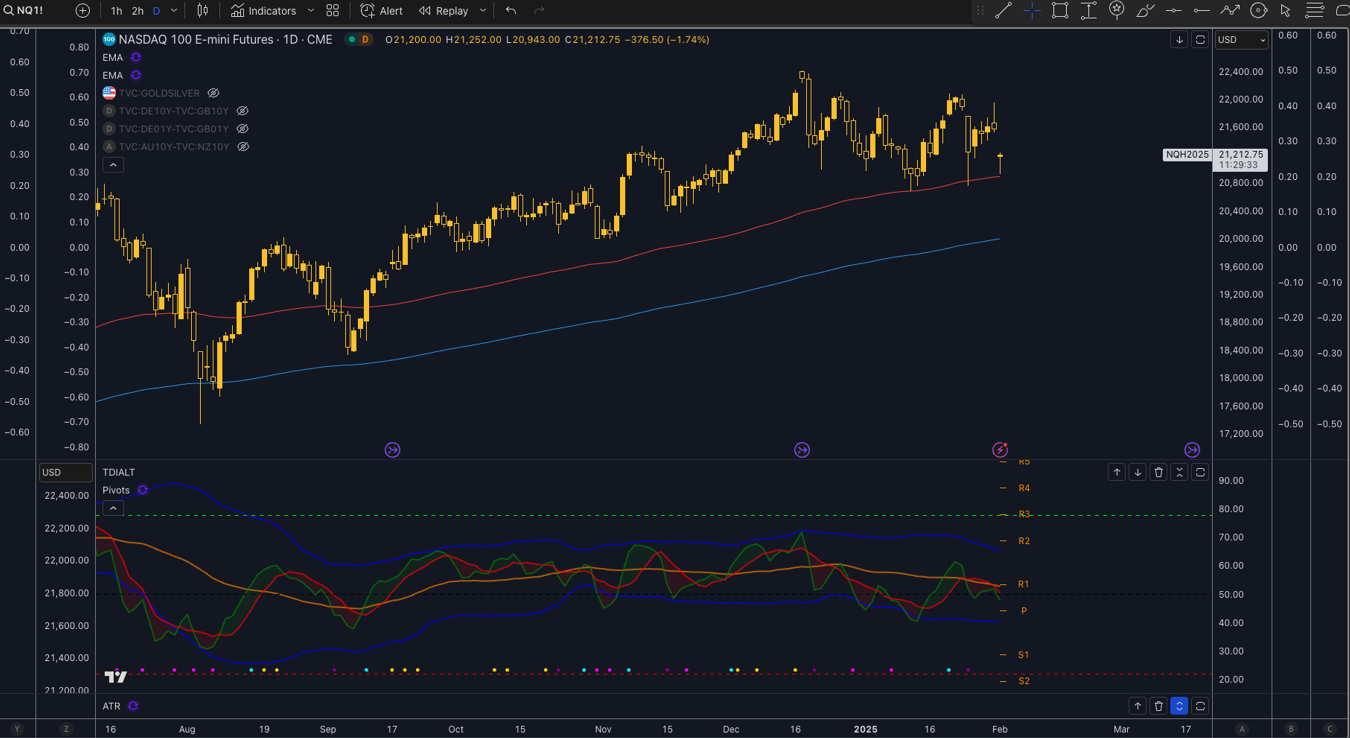

A technical look at the Nasdaq shows that the 100 and 200EMA sits below price on the daily chart (blue and red line below) and investors will be watching how much tariff concerns weigh on price heading into Friday’s NFP print.(Click on image to enlarge) Trade risksThe outlook for the Nasdaq over the NFP will be highly influences by the data released. There is therefore a significant data release risk to be aware of.Video Length: 00:02:46Is Rising UK Wage Inflation A Threat To J Sainsbury’s Share Price?How Will A Fed ‘Hold’ This Week Impact The EURUSD? Does The FTSE 100 Have Another Leg Higher To Come?

Trade risksThe outlook for the Nasdaq over the NFP will be highly influences by the data released. There is therefore a significant data release risk to be aware of.Video Length: 00:02:46Is Rising UK Wage Inflation A Threat To J Sainsbury’s Share Price?How Will A Fed ‘Hold’ This Week Impact The EURUSD? Does The FTSE 100 Have Another Leg Higher To Come?