Global e-commerce giant Amazon.com Inc. ( – ) is set to report fourth-quarter 2024 on Feb. 6, 2025, after the closing bell. The stock currently carries a Zacks Rank #2 (Buy) and has an of +4.78%. Our research shows that for stocks with the combination of a Zacks Rank #3 (Hold) or better (Rank #1 or 2) and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings release. You can uncover the best stocks to buy or sell before they’re reported with our .

Factors to ConsiderAmazon is gaining on solid Prime momentum owing to ultrafast delivery services and a strong content portfolio. Strengthening relationship with third-party sellers is a positive. The growing adoption of the AWS services portfolio is aiding AMZN’s cloud dominance. A robust advertising business is also contributing well. Amazon’s strong global presence remains a key growth driver. Deepening focus on generative AI is a major plus. AMZN’s AWS is the largest cloud service provider beating Microsoft Corp.’s ( – ) Azure and Alphabet Inc.’s ( – ) cloud services. AMZN reported record business in the 2024-25 holiday season in terms of both sales and items sold.Also, the improving AI-powered Alexa business, along with robust smart home product offerings, is acting as a tailwind. Growing capabilities in grocery, pharmacy, healthcare and autonomous driving are the other positives. We expect 2024 net sales to increase 10.7% from 2023.The chart below shows the price performance of AMZN compared with other “Magnificent 7” stocks in the past month. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

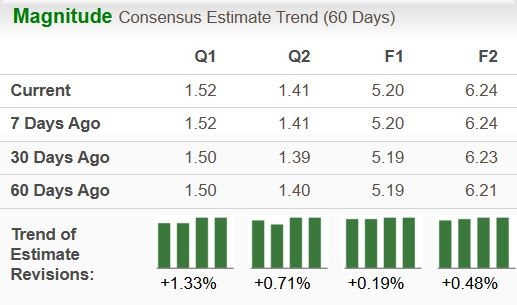

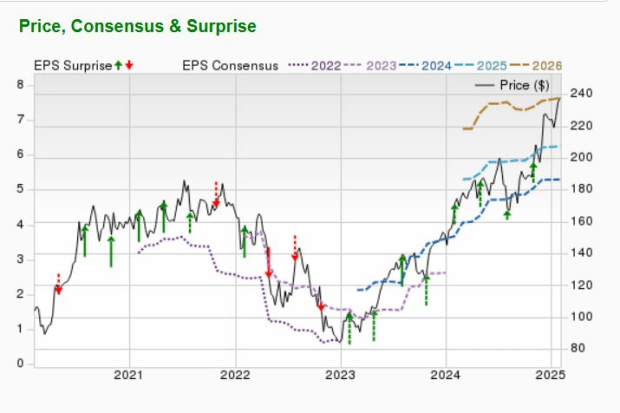

Robust Earnings Estimate Revisions for AMZN StockFor fourth-quarter 2024, the Zacks Consensus Estimate currently shows revenues of $187.28 billion, suggesting an improvement of 10.2% year over year and earnings per share (EPS) of $1.52, indicating an increase of 50.5% year over year. The Zacks Consensus Estimate for fourth-quarter 2024 earnings has improved 1.3% over the last 30 days. AMZN reported positive earnings surprises in the last four reported quarters with an average beat of 25.9%.At present, the Zacks Consensus Estimate indicates a year-over-year increase of 10.9% and 79.3%, respectively, for revenues and EPS in 2024. The Zacks Consensus Estimate for 2024 earnings has improved 0.2% over the last 30 days.Even after this upward revision, the current Zacks Consensus Estimate for 2025 revenues and EPS reflects an upside of 10.8% and 20.1%, respectively. The Zacks Consensus Estimate for 2025 earnings has improved 0.3% over the last 30 days. AMZN currently has a long-term (3-5 years) EPS growth rate of 28.2%, well above the S&P 500’s long-term EPS growth rate of 12.4%. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Solid Short-Term Price Upside Potential for AMZN SharesAMZN has a return on equity of 22.41% compared with -4.62% of the industry and 16.88% of the S&P 500 Index. The for the stock represents an increase of 6.1% from the last closing price of $236.17. The brokerage target price is currently in the range of $212-$306. This indicates a maximum upside of 29.5% and a maximum downside of 10.2%. Image Source: Zacks Investment ResearchBuy The Pullback In Alphabet Stock After Q4 Earnings? Qualcomm Q1 Earnings And Revenues Surpass Estimates Walt Disney Beats Q1 Earnings And Revenue Estimates

Image Source: Zacks Investment ResearchBuy The Pullback In Alphabet Stock After Q4 Earnings? Qualcomm Q1 Earnings And Revenues Surpass Estimates Walt Disney Beats Q1 Earnings And Revenue Estimates