Alphabet’s Q4 Results

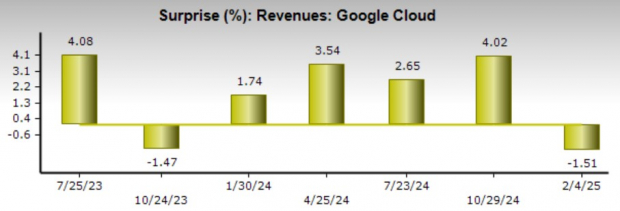

Alphabet’s Q4 sales after traffic acquisition costs (TAC) was $81.62 billion, a 12% increase from the comparative quarter, and exceeded Zacks estimates of $81.37 billion. Notably, Google Cloud revenue was up 30% to $11.95 billion versus $9.19 billion a year ago. However, this missed estimates of $12.13 billion by -1.51%, with Amazon Web Services and Microsoft Azure still having a controlling share of the cloud market ahead of Alphabet. Image Source: Zacks Investment ResearchOn the bottom line, Q4 net income came in at $26.5 billion or $2.15 per share which edged expectations of $2.12 and spiked 31% from EPS of $1.64 in the prior period. Alphabet has now exceeded earnings expectations for eight consecutive quarters with an average EPS surprise of 11.57% in its last four quarterly reports.

Image Source: Zacks Investment ResearchOn the bottom line, Q4 net income came in at $26.5 billion or $2.15 per share which edged expectations of $2.12 and spiked 31% from EPS of $1.64 in the prior period. Alphabet has now exceeded earnings expectations for eight consecutive quarters with an average EPS surprise of 11.57% in its last four quarterly reports.

Image Source: Zacks Investment Research

Full Year Results

Rounding out fiscal 2024, Alphabet’s total sales spiked 14% to $350 billion versus $307.39 billion in 2023. Even better, annual earnings soared 38% to $8.04 per share from EPS of $5.80 in 2023.

Alphabet’s CapEx Guidance

While Alphabet doesn’t provide specific guidance, the tech giant does expect its capital expenditures to increase by nearly 43% in FY25 to $75 billion compared to $52.5 billion last year. The increase in spending appears to worry Wall Street although Alphabet stated the sharp rise in CapEx will be needed to expand its AI efforts, primarily for its technical infrastructure as it relates to servers, data centers, and networking.

Strong Balance Sheet & “Cheap” Valuation

Alphabet does have a strong balance sheet that should be able to support these rising costs and still fuel its growth as well. To that point, Alphabet has a $95 billion cash pile and total assets of $450.25 billion which is nicely above its total liabilities of $125.17 billion. What may also appeal to long-term investors after the post-earnings selloff is that Alphabet still has the cheapest P/E valuation of the Magnificent 7-themed tech stocks at 23.1X forward earnings. This is just beneath Meta Platforms ( – ) at 27.1X, with cloud competitors Amazon and Microsoft at 38.7X and 31.6X respectively.

Image Source: Zacks Investment Research

Bottom Line

There are certainly mixed opinions on whether Alphabet will be able to sustain its attractive growth trajectory with GOOGL shares up a very respectable +30% in the last year. For now, Alphabet stock lands a Zacks Rank #3 (Hold).