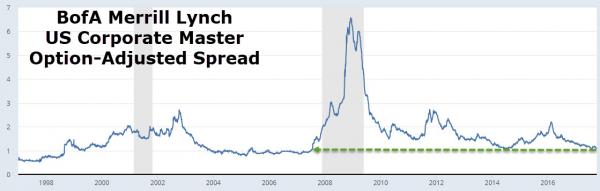

Credit spreads have collapsed in recent weeks – back to post-crisis lows…

As Stone-McCarthy writes, the Investment Grade Markit CDX North American Index was 54.2 basis points yesterday, just down from 54.6 basis points on Monday, and it is trading at 54.8 basis points so far this morning. Yesterday’s reading was the lowest reading for the index, which dates back to September 2011. The High Yield CDX Index was 320.1 basis points yesterday, down from 322.3 basis points on Monday, and it is trading at 321.8 basis points so far this morning. Yesterday’s close was the lowest since August.

Additionally, The BoA/ML Corporate Master Index OAS fell to just 105 basis points from 106 basis points on Monday. That’s the lowest it’s been in more than ten years, since July 19, 2007. We don’t yet have the High Yield Master II Index OAS for yesterday, but it was 355 basis points yesterday, down from 356 basis points on Monday. That matches the low from late July, which is the lowest it’s been since July 9, 2014.

All of which makes zero sense as leverage has never been higher…

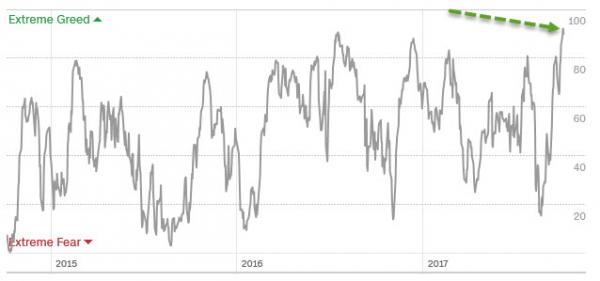

But then again, market ‘greed’ has almost never been higher…

CNN’s Fear & Greed index soared to 96– tied for the 2nd highest reading since 1998…

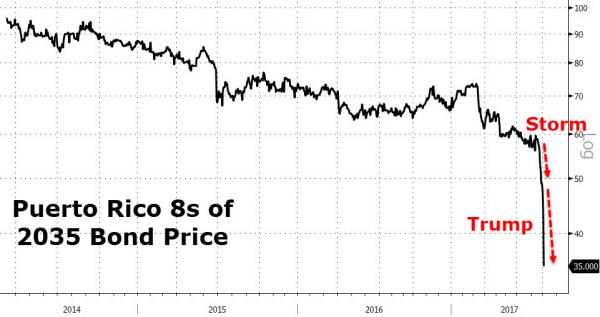

Ironically, as credit spreads on massively-levered corporate bonds hit post-crisis-lows, Puerto Rico bonds are collapsing…

Behold the bloodbath in Puerto Rico GOs after Trump’s “wipe ’em out” comments…

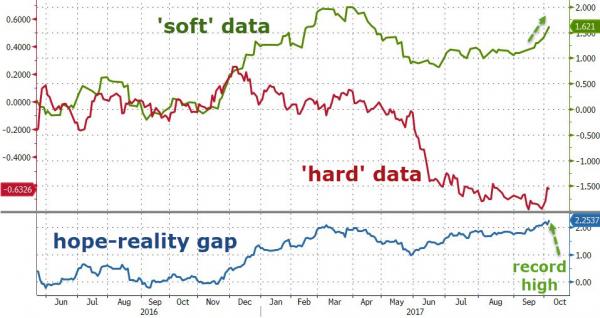

And before we get to the broader markets, today’s epic 5 sigma beat in ISM Services (which makes all the sense in the world), spiked ‘soft’ data back to 6-month highs (as hard data hovers around 8 year lows). This is the biggest gap between hard and soft data (lower panel) ever…

***

In a shocking moment of truth for many investors, Small Cap stocks ended the day lower (unable to ramp like yesterday) but S&P, Dow, and Nasdaq held on to gains… (as Trannies underperformed)