The United States has just set two new world records: one for its debt, the other for its deficit.Let’s begin by analyzing the country’s latest debt figures.Total U.S. debt (public and private combined) now exceeds $35 trillion:

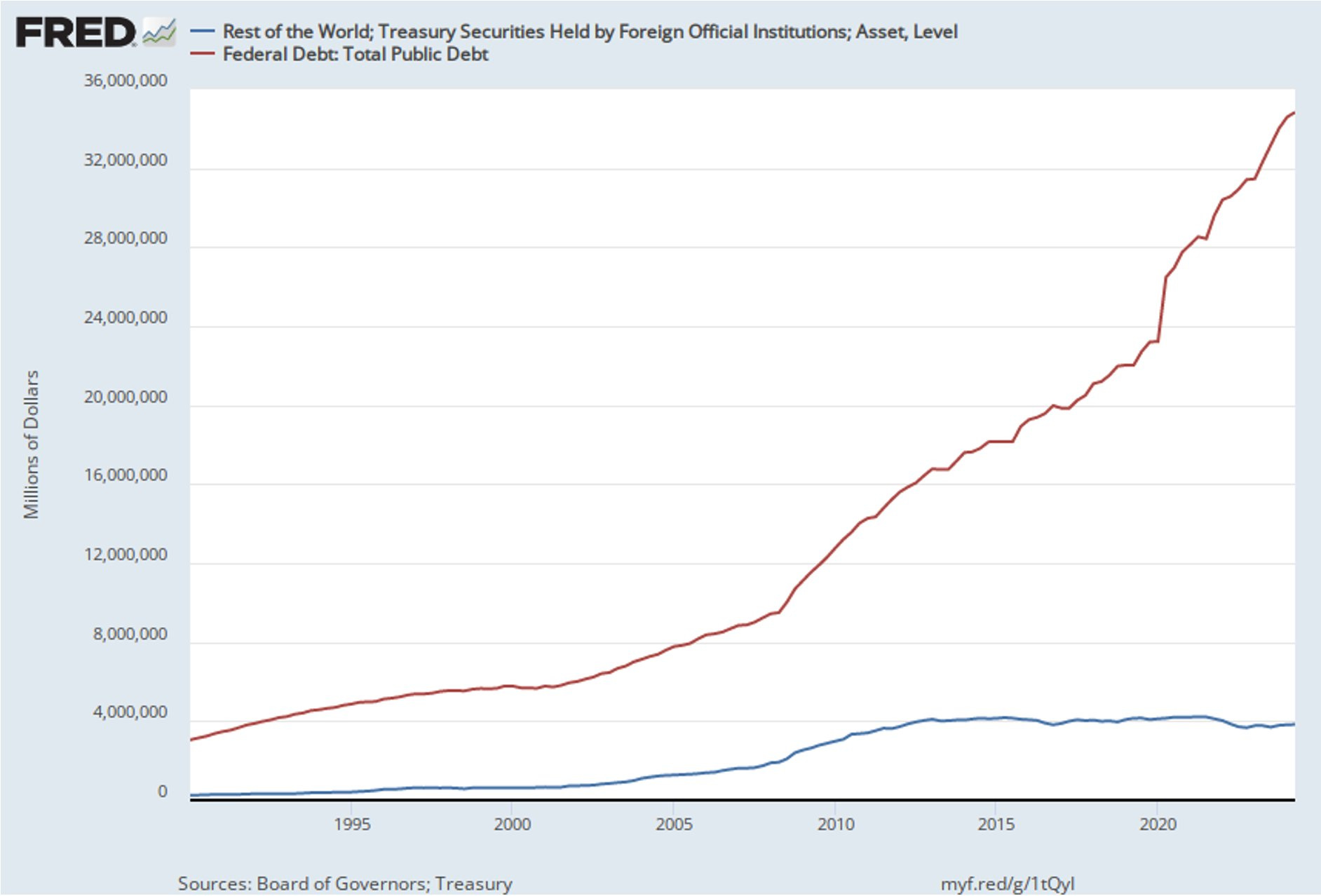

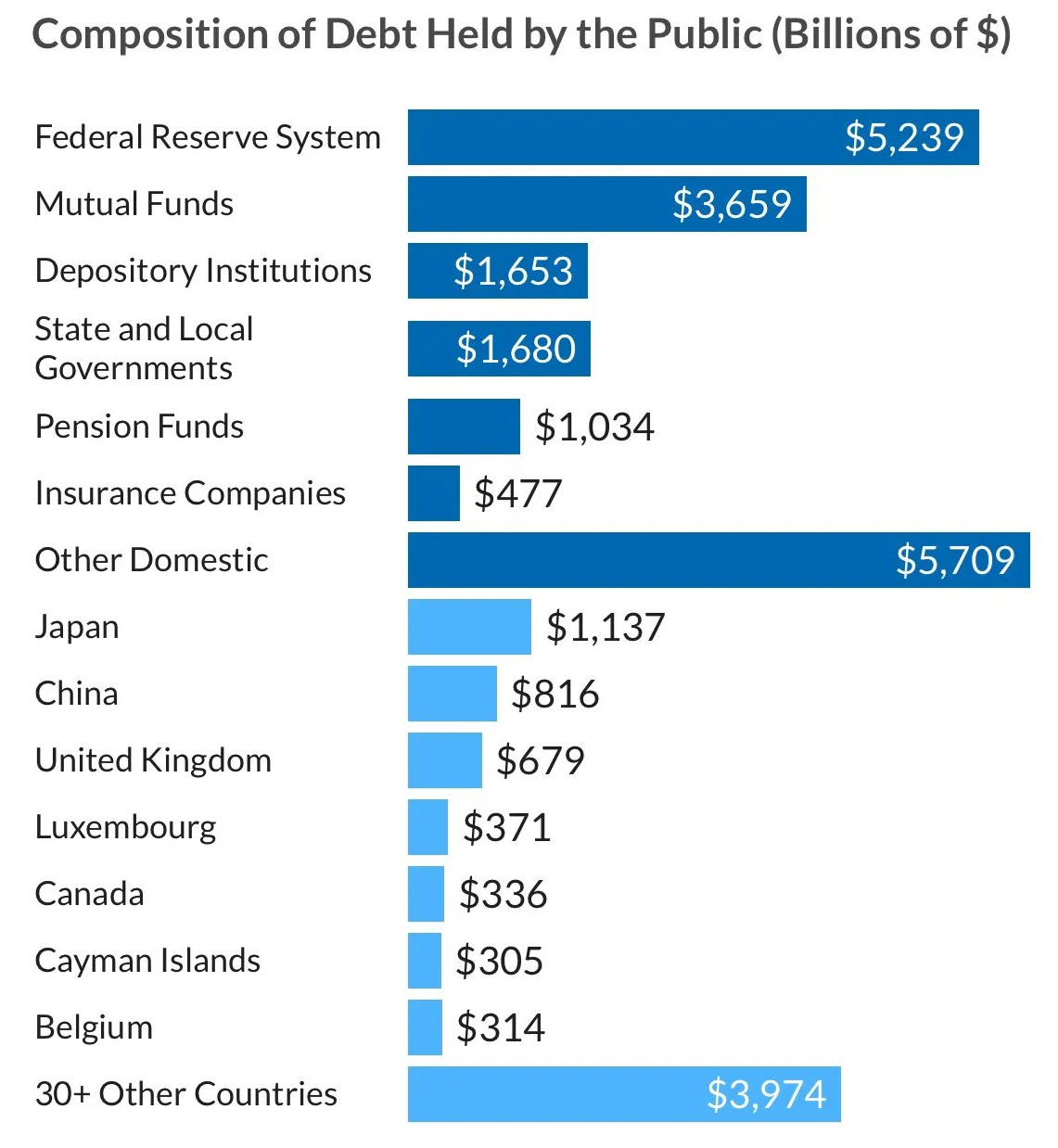

The vast majority of U.S. debt is held domestically, while the share held by foreign entities is declining as a percentage of total debt:

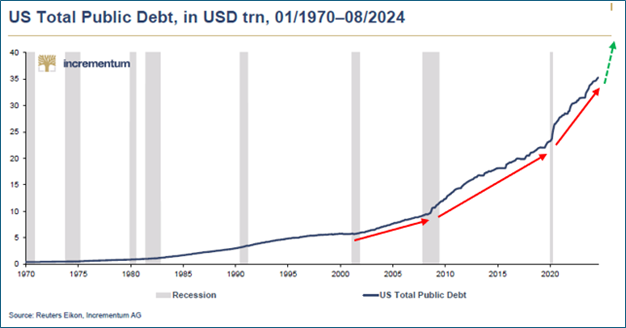

The proportion of US debt held by foreign institutions has not increased over the past ten years. Meanwhile, public debt has continued to grow.We are currently witnessing an even more pronounced cycle of debt expansion. Since 2000, the slope of the curve representing this debt has steepened three times, and we are now at the start of a new acceleration in US public debt:

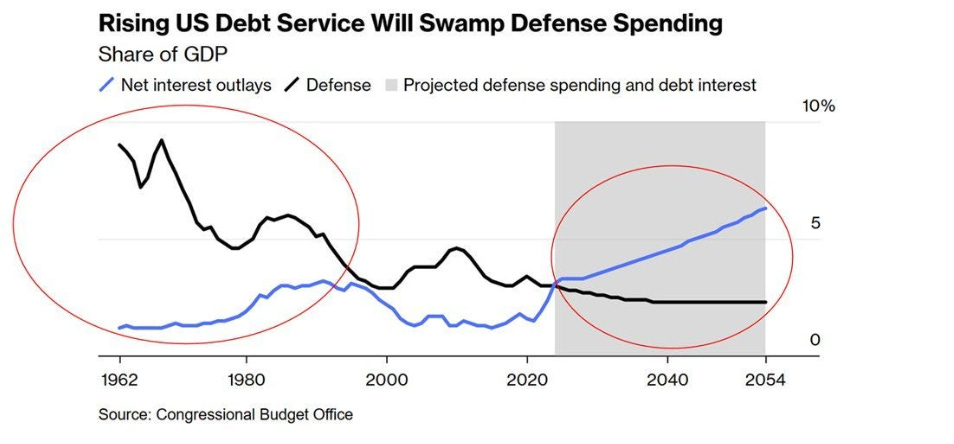

U.S. public debt has reached a record $34.5 trillion. Since June, it has been increasing by $1 trillion every 100 days. The debt-to-GDP ratio currently stands at 123.7%, approaching the peak of 126.2% recorded during the pandemic.Historically, countries with a debt-to-GDP ratio in excess of 130% often default on their debts.This risk increases as the dollar loses its status as the main currency in international trade. Logically, if foreign countries use the dollar less, they will be less inclined to buy US debt. Although the dollar is still a long way from losing its dominant status, a slight drop in its demand could aggravate tensions surrounding the exploding US debt, which requires ever greater demand.Over the past 12 months, government spending on interest payments on its debt has reached a record $1.12 trillion, doubling in the space of two years. The debt burden now exceeds Social Security funding, becoming the largest expense in the federal budget.The debt’s interest burden also exceeds the budget allocated to defense:

Historian Niall Ferguson has noted that, in many countries, when public spending on debt servicing exceeds that of the defense budget, this often marks the beginning of a decline.In other words, Ferguson suggests that a country that devotes more resources to debt repayment than to defense could be losing sovereignty or geopolitical power. Ferguson’s “law” clearly suggests that the United States is currently in a risky situation due to its level of debt.Another complicating factor is that the country’s public debt has a very short maturity. This means that the country will have to refinance this massive debt in the very near future.

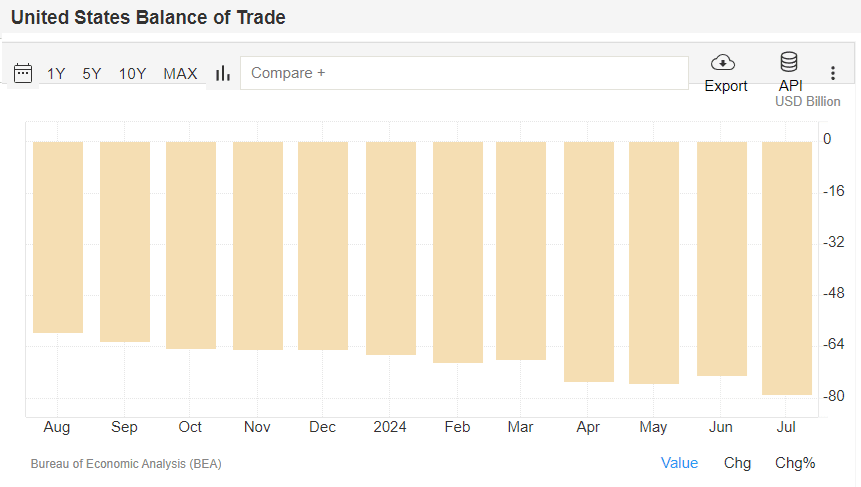

The cost of this refinancing is the main reason why Jerome Powell has adopted such an aggressive rate-cutting policy. It is crucial that rates fall to alleviate the cost of debt refinancing for the Treasury. It doesn’t matter whether this provokes criticism of the central bank’s independence, or whether a rapid rate cut could lead to a resurgence of inflation in the medium term. The emergency is government financing, and the chart of US debt maturities perfectly illustrates the Fed’s decision to cut rates by fifty points this Wednesday.The second record of the week concerns the US deficit, which is twofold: a record budget deficit and a record trade deficit.In July 2024, the US trade deficit widened to $78.8 billion, the largest gap since June 2022:

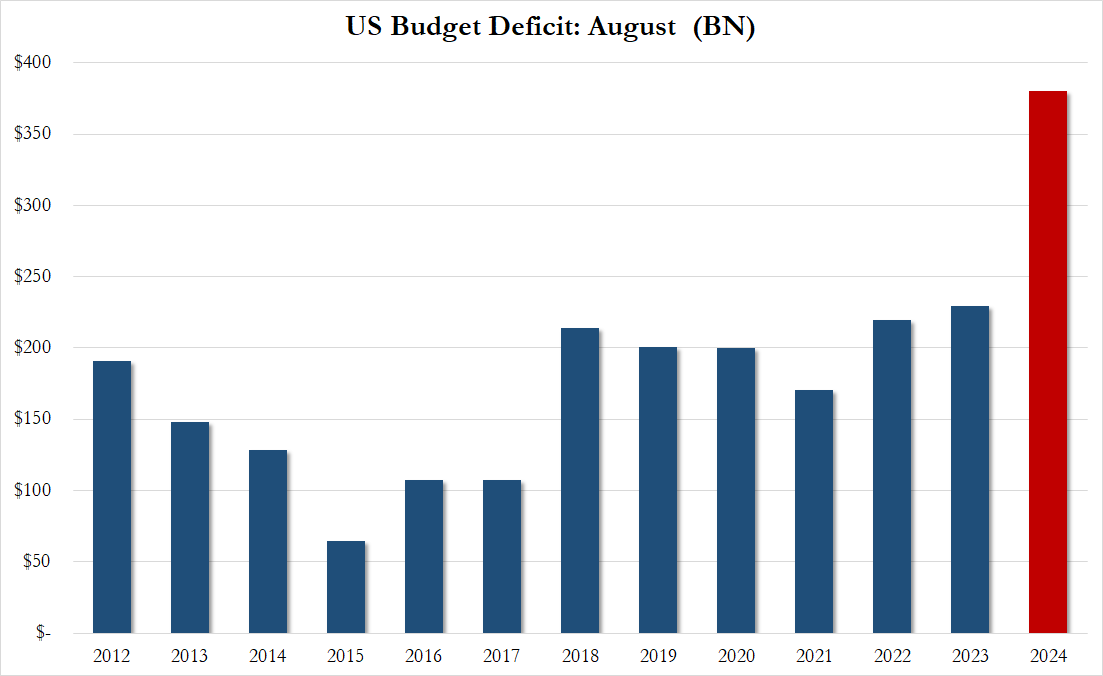

The trade deficit with China widened by $4.9 billion to $27.2. Meanwhile, exports to China fell by $1 billion to $11.5 billion, while imports climbed by $3.9 billion to $38.7 billion.In August, the budget deficit was significantly higher than expected. The figures, already expected to be up on the previous month ($290 billion), are staggering: a $380 billion budget deficit in one month. This amount, an all-time record, exceeds the most pessimistic forecasts by $80 billion:

US fiscal recklessness crosses a new threshold. This situation is the result of both the increased burden of debt repayment and a classic election-period budgetary relaxation.This time, the bad figures did not go unnoticed. The announcement of this budgetary slippage caused the to soar recently.Falling interest rates are having an impact on gold, but the state of US public finances is also playing a role in the precious metal’s rise. Since the decisive breakout last spring, which marked the end of thirteen years of consolidation, gold has set one record after another:(Click on image to enlarge) France’s Deficit Under EU And Market ScrutinyGold In Euros Breaks All-Time RecordGold: A Way To Optimize Your Savings

France’s Deficit Under EU And Market ScrutinyGold In Euros Breaks All-Time RecordGold: A Way To Optimize Your Savings