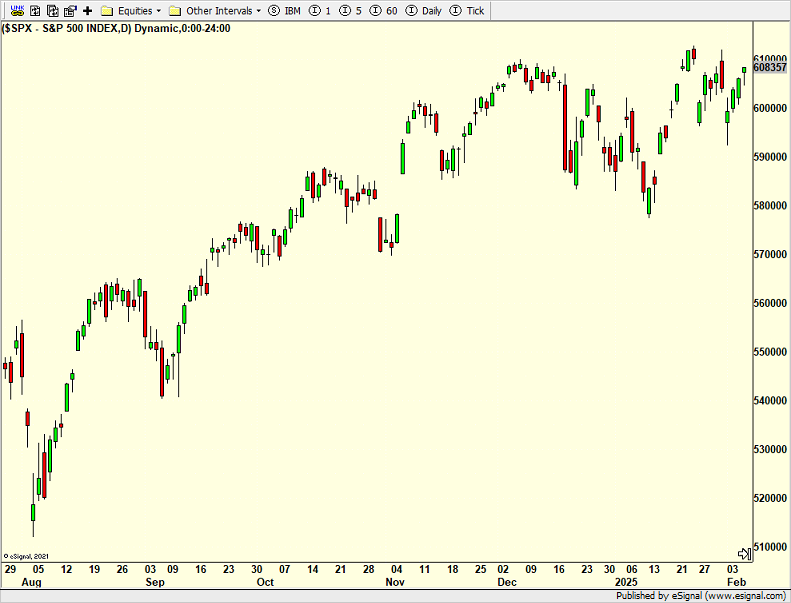

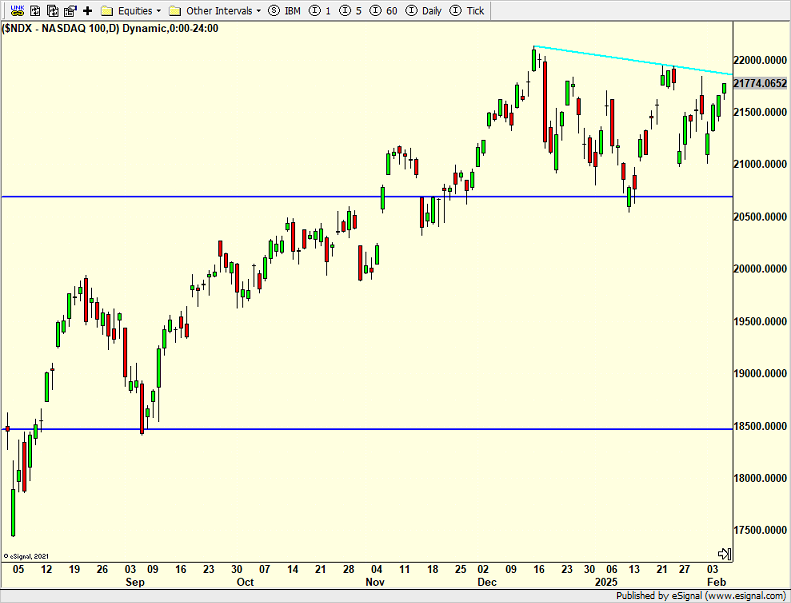

Two straight weeks of blue Mondays followed by market bounces. The S&P 500 is just a good day away from new highs although my thinking has not changed that it would be more of a selling opportunity than a buying of momentum one. That will change, but not before we see a more meaningful downside to cleanse the greed and euphoria. I guess the S&P 500 could run a few percent in new highs, but I still think it needs damage to be repaired. The Nasdaq 100 looks similar, but a touch weaker. I think it has withstood less than inspiring earnings from most of the top companies without falling apart. In actuality, the other 90 in the index have been behaving better than the top 10.

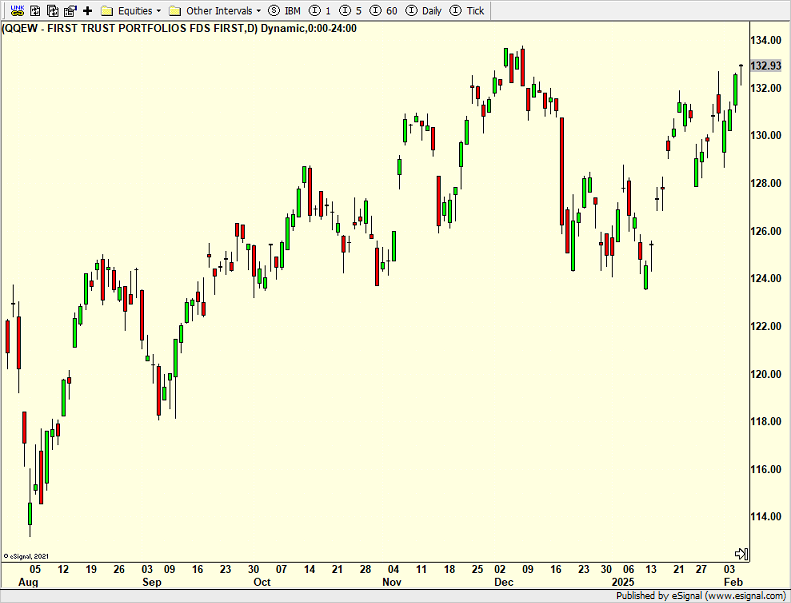

The Nasdaq 100 looks similar, but a touch weaker. I think it has withstood less than inspiring earnings from most of the top companies without falling apart. In actuality, the other 90 in the index have been behaving better than the top 10. You can see this playing out in the chart below which is the equal-weighted Nasdaq 100, meaning that all 100 companies have a 1% weight versus the cap-weighted index where companies are weighted by size.

You can see this playing out in the chart below which is the equal-weighted Nasdaq 100, meaning that all 100 companies have a 1% weight versus the cap-weighted index where companies are weighted by size. In both cases, the indices are up against areas where the bears should try and make a stand. If they fail, I would look for new highs and a small spurt before rolling over again.On Thursday we bought more and . We sold AMPS, , some and some .Tariffs Creating Investor AnxietyDeepSeek Last Monday – Tariffs TodayNot A Market To Chase

In both cases, the indices are up against areas where the bears should try and make a stand. If they fail, I would look for new highs and a small spurt before rolling over again.On Thursday we bought more and . We sold AMPS, , some and some .Tariffs Creating Investor AnxietyDeepSeek Last Monday – Tariffs TodayNot A Market To Chase