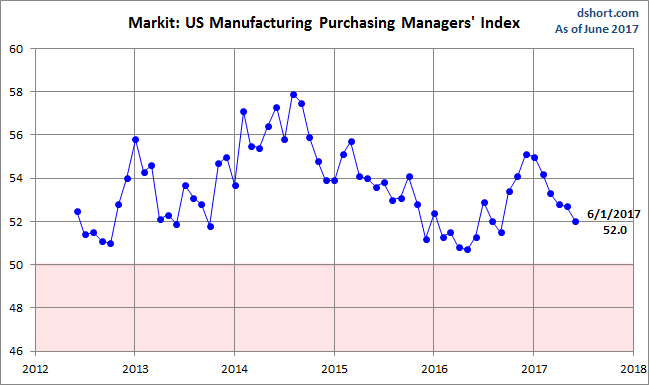

The June US Manufacturing Purchasing Managers’ Index conducted by Markit came in at 52.0, down from the 52.7 final May figure. Today’s headline number was slightly below the Investing.com forecast of 52.1. Markit’s Manufacturing PMI is a diffusion index: A reading above 50 indicates expansion in the sector; below 50 indicates contraction.

Here is the opening from the latest press release:

June data pointed to a relatively subdued month for the U.S. manufacturing sector, with output, new order and employment growth all slowing since May. At the same time, survey respondents signalled resilient confidence towards the year ahead outlook, with optimism up to its strongest level since February. Meanwhile, cost pressures were the weakest recorded for 15 months, which resulted in the slowest pace of factory gate price inflation since late-2016.

The seasonally adjusted IHS Markit final US Manufacturing Purchasing Managers’ Index™ (PMI™)registered 52.0 in June, down from 52.7 during May, to signal the least marked improvement in overall business conditions since September 2016. Slower rates of output and new business growth were the main factors weighing on the headline PMI in June, which more than offset a stronger contribution from the stocks of purchases component. [Press Release]

Here is a snapshot of the series since mid-2012.

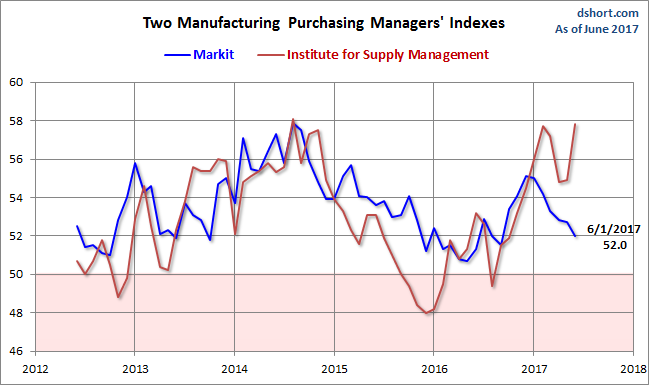

Here is an overlay with the equivalent PMI survey conducted by the Institute for Supply Management (see our full article on this series here, note that ).

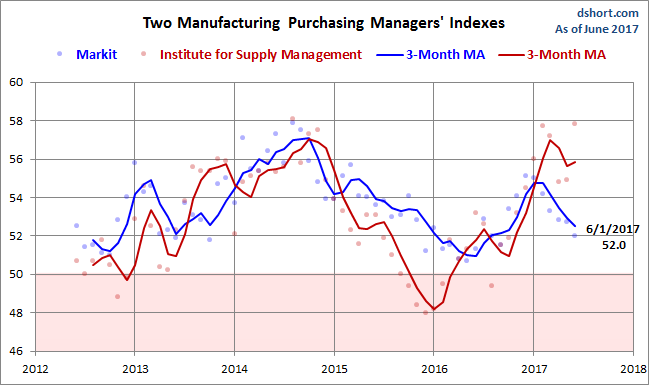

The next chart uses a three-month moving average of the two rather volatile series to facilitate our understanding of the current trend.

The two moving-average series began diverging in early 2015. The ISM index expanded through most of 2016, but has seen a decline this year. The Markit series has trended more steadily downward from its interim high early in the second half of 2014.