Econintersect’s Economic Index marginally improved and squeaked back into territory associated with normal growth. Economic growth in 2017 has remained in a very narrow band.

Analyst Summary of this Economic Forecast

A portion of the improvement this month is a bounce back from the effects of the hurricanes.

Even though not in our forecast, we remain concerned about the elevated income to spending ratios which paints a picture of a consumer spending all of its income – with little room for additional spending or ability to weather rainy days (or say hurricanes).

Our 6-month employment forecast indicates a decline in the rate of employment growth.

This index is not designed to guess GDP – or the four horsemen used by the NBER to identify recessions (industrial production, business sales, employment and personal income). It is designed to look at the economy at the Main Street level.

The graph below plots GDP (which has a bias to the average – not median – sectors) against the Econintersect Economic Index.

This post will summarize the:

Special Indicators:

The consumer is still consuming. The ratio of spending to income has been very elevated since September 2016. There have been only three extended periods in history where the ratio of spending to income has exceeded 0.92 (the months surrounding the 2001 recession, from September 2004 to the beginning of the 2007 Great Recession, and since September 2016).

Seasonally Adjusted Spending’s Ratio to Income (an increasing ratio means Consumer is spending more of Income)

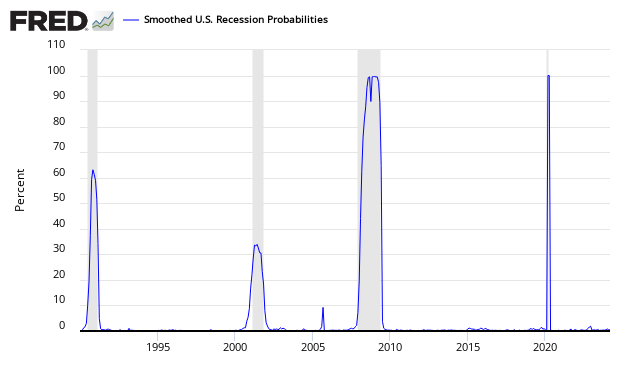

The St. Louis Fed produces a Smoothed U.S. Recession Probabilities Chart which is currently giving no indication of an oncoming recession.

Smoothed recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. This model was originally developed in Chauvet, M., “An Economic Characterization of Business Cycle Dynamics with Factor Structure and Regime Switching,” International Economic Review, 1998, 39, 969-996. (http://faculty.ucr.edu/~chauvet/ier.pdf)

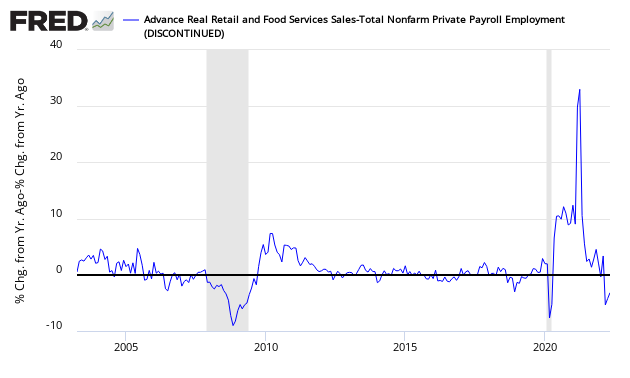

Econintersect reviews the relationship between the year-over-year growth rate of non-farm private employment and the year-over-year real growth rate of retail sales. This index is now barely positive. When retail sales grow faster than the rate of employment gains (above zero on the below graph) – a recession is not imminent. However, this index has many false alarms.

Growth Relationship Between Retail Sales and Non-Farm Private Employment – Above zero suggests economic expansion

GDPNow

The growth rate of real gross domestic product (GDP) is the headline view of economic activity, but the official estimate is released with a delay. Atlanta’s Fed GDPNow forecasting model provides a “nowcast” of the official estimate prior to its release. Econintersect does not believe GDP is a good tool to view what is happening at Main Street level – but there are correlations.

Latest forecast: 2.7 percent — October 18, 2017

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2017 is 2.7 percent on October 18, unchanged from October 13. The forecast of third-quarter real residential investment growth inched down from -4.1 percent to -4.3 percent after this morning’s new residential construction release from the U.S. Census Bureau.

The next GDPNow update is Wednesday, October 25. Please see the “Release Dates” tab below for a full list of upcoming releases.