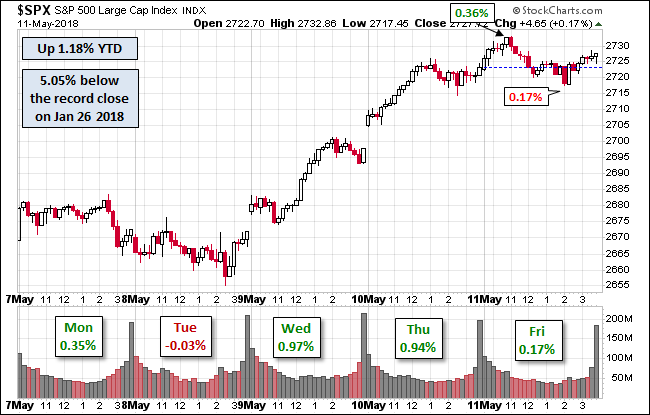

Fed Wednesdays are frequently accompanied by market volatility around the afternoon release of the Fed minutes. Today was no exception. The S&P 500 rallied during the opening 90 minutes and then drifted sideways until about five minutes before the 2PM event. A small jump lifted the index to a 0.90% pre-Fed high, which was instantly followed by a dramatic plunge to its -0.13% intraday low. The low, was the followed by a new rally that lifted the index to close at its 1.18% intraday high.

CNBC has an enlightening snapshot of what changed in the latest Fed statement. On balance the changes were more positive than the previous statement, and a December rate hike appears to remain on the table. It will be interesting to see if, after sleeping on it, the US market remains in rally mode.

The yield on the 10-year note closed at 2.10%, up 5 bps from the previous close.

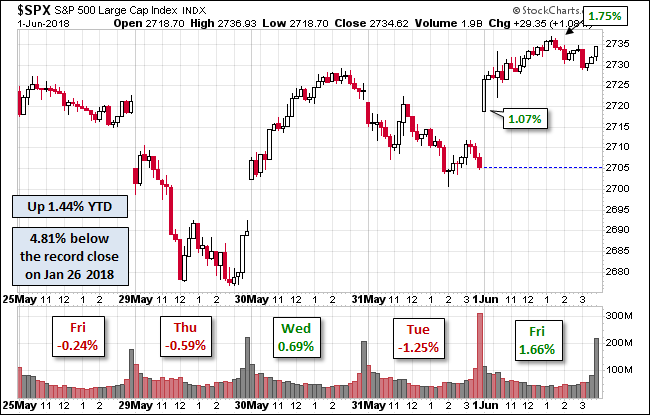

Here is a snapshot of past five sessions.

Fed Wednesday trading volume was unremarkable. The S&P 500 has now distanced itself above its 200-day price moving average.

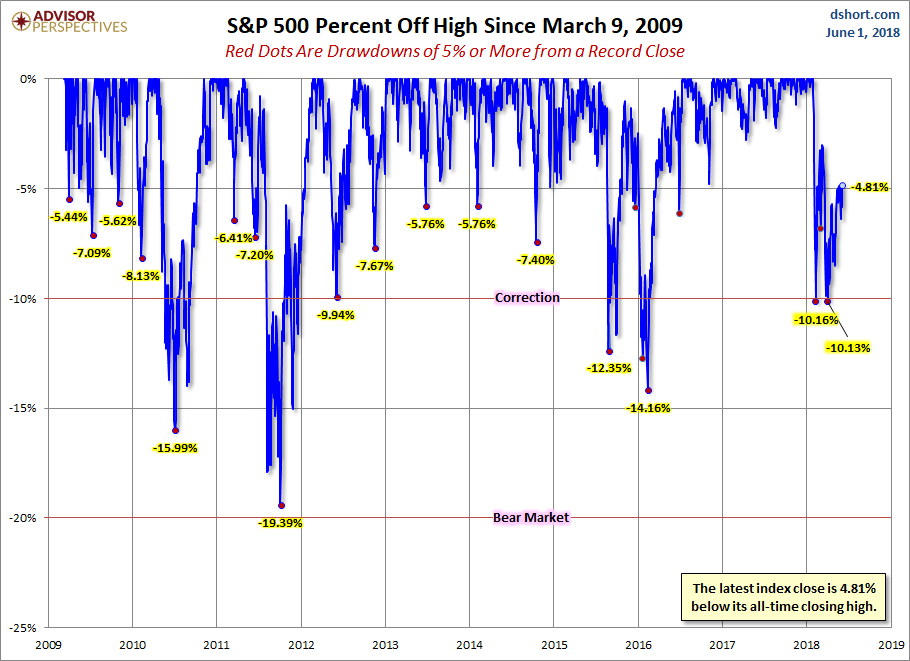

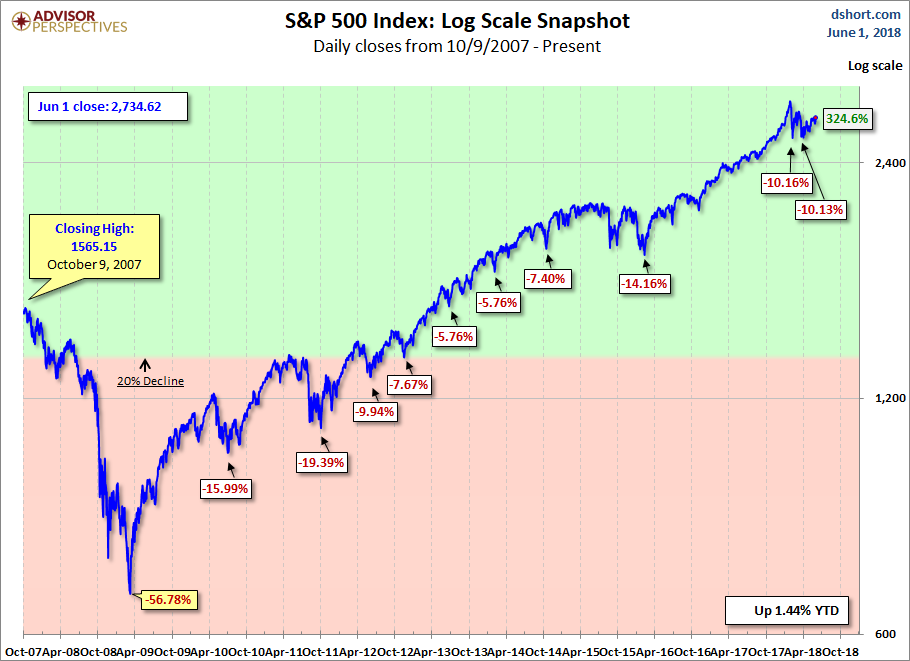

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

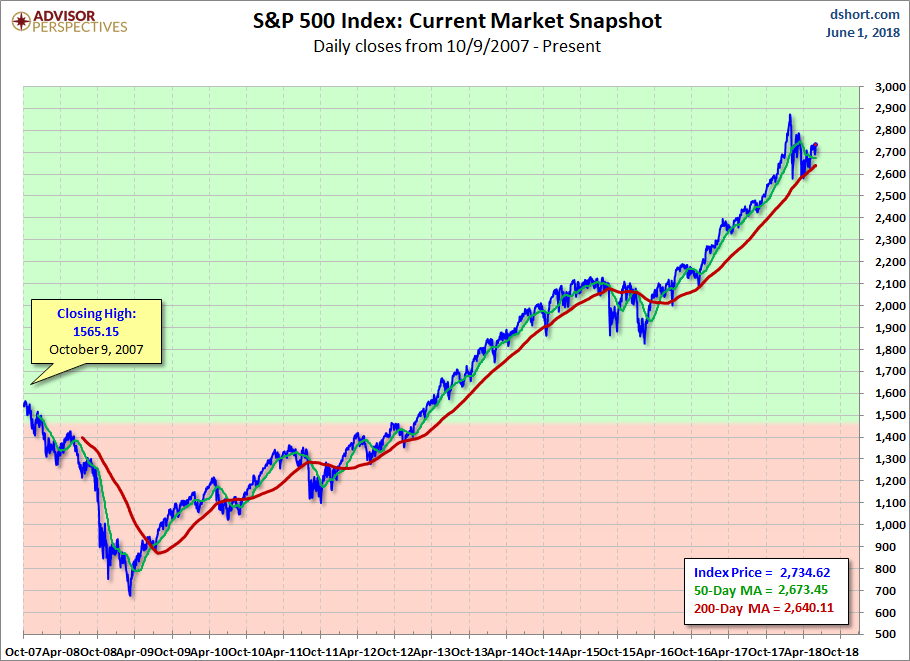

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

Here is the same chart with the 50- and 200-day moving averages. The 50 crossed below the 200 on August 28th.