<< Read Part 1: Below are some of the most interesting things I came across this week.LINKFollowing up on his earlier piece published a couple of weeks ago, writes, “by some point next year, investors will likely balk and demand higher interest rates or a demonstration of fiscal discipline,” which could be the catalyst for the bursting of the “” in the U.S. stock market.

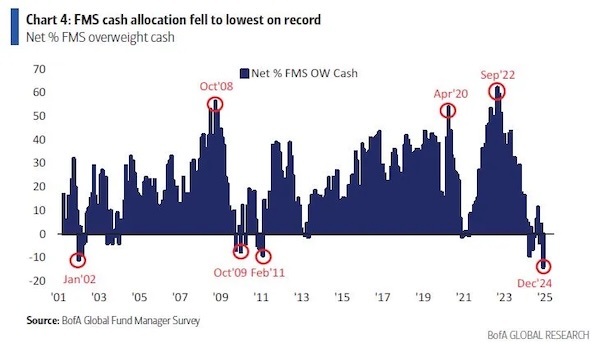

STATFund managers certainly haven’t gotten this message. According to , recently they “have been reducing cash holdings to a record low and pouring money into US stocks.”

LINKHowever, there is a growing chorus, both inside the Fed and outside of it, who are increasingly beginning to worry that the Fed’s loosening of financial conditions this year could prove to be another .

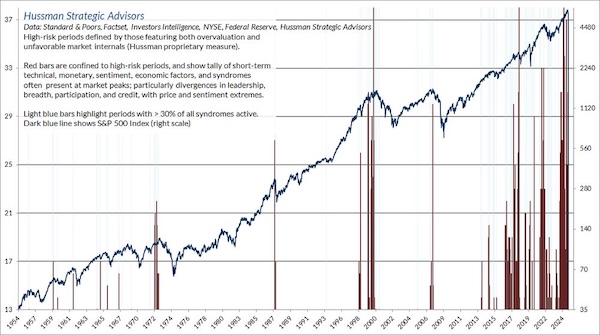

CHARTAnd the message from within the stock market seems to validate Sharma’s views. As notes, “There are certain features of valuation, investor psychology, and price behavior that emerge when FOMO becomes particularly extreme and the focus of speculation becomes particularly narrow. On Monday, we observed an explosion of these warning syndromes.”

LINKFinally, there may be opportunities presented by the rise in volatility to put money to work but, according to the actions of the , they may not be in those areas of the market that have attracted the most attention.