The pullback in Treasury bond ETFs over the last three weeks has caught many fixed-income investors off guard. The stock market volatility in January pushed yields on the 30-Year Treasury Note Yield (TYX) to all-time lows, which consequently led to strength in funds such as the iShares 20+ Year Treasury Bond ETF (TLT) and Vanguard Extended Duration ETF (EDV).

This flight to quality seemed like a no-brainer at the time given the uncertainty surrounding the direction of equities and the unbelievable low and/or negative yields in international bond markets. A credit-risk free U.S. Treasury trending strongly higher and with yields many times higher than an equivalent foreign issuer was just too good to pass up.

However, those that bought near the January highs may be feeling some buyer’s remorse as the focus shifts to better than expected economic data fueling expectations of a 2015 Fed rate hike. Of course, longer duration securities are going to be far more susceptible to interest rate swings as we experience a pullback in bullish sentiment for Treasuries.

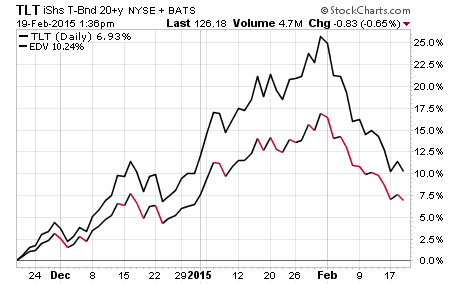

As you can see in the 3-month chart below, TLT is roughly 10% off its high, while EDV is approximately 15% lower. Both ETFs are now showing essentially flat performance in 2015.

According to data from ETF.com, investors poured nearly $1 billion of combined assets into TLT, EDV, and the iShares 7-10 Year Treasury Bond ETF (IEF) as prices peaked in January. Just like in stocks, fixed-income investors tend to chase performance right until they shake the last bullish penny out of the market.

So the real question now is – where do interest rates go from here and how should you position your bond portfolio to adapt to these changes?

There are really two key paths this trade is likely to follow: